Compliments of

President | NMLS #: 297154

Hawaii Mortgage Company, Inc.

Company NMLS #: 232582

Alan Van Zee is one of the top producing Mortgage Originators in the state, originating over $2,000,000,000 to date. He has written and published this weekly newsletter for the past 18 years. It is the most widely read mortgage, real estate, and finance publication in Hawaii.

Hawaii Mortgage Company, now in our 26th year of providing mortgages to the people of Hawaii, is proud to have a complaint-free history. We make sure our clients are happy!

News and Insight

For the Weekend of January 3rd, 2026

Hawaii’s Most Read Mortgage, Real Estate, and Finance Publication for 18 Years

Volume 18 – Issue 15

2026 Forecast & Predictions

I hope everyone had a safe and fun time ringing in the new year. Let’s all hope that 2026 brings joy and good tidings to all. Despite what the news reported, I witnessed more aerial fireworks this year than last. The best quote from the news coverage was “we still have a lot of work to do…” That from one of the government officials realizing that despite their best efforts, lots of illegal fireworks were purchased and set off.

I’ll be honest – I used to love setting off fireworks as a kid. But now older and the proud dad of a hunting dog scared to death of the loud booms; it does take a lot away from that midnight celebration. If we can’t stop the aerials, how about just getting rid of the percussion bombs that seem to shake the entire neighborhood?

I’ll be honest – I used to love setting off fireworks as a kid. But now older and the proud dad of a hunting dog scared to death of the loud booms; it does take a lot away from that midnight celebration. If we can’t stop the aerials, how about just getting rid of the percussion bombs that seem to shake the entire neighborhood?

Fortunately, once the booms stopped, and this year everything stopped right around 12:15 a.m., Holly was back to her normal self.

Let’s jump right into the predictions for 2026.

Mortgage Interest Rates:

Looking back at 2025, I was wrong about interest rates. I predicted we would see conforming mortgage rates dipping into the upper 5% range without paying points. We were close, as rates ended the year just above 6.000%. Maybe if we didn’t have the government shutdown that delayed the economic data used by bond traders, we could have gotten there.

For 2026, mortgage rates will finally get back into a reasonable range, with rates starting with the number 5. Don’t cheer too loudly, as I don’t see rates heading anywhere near the upper 4% range. We may see a time when the zero-point rate drops below 5.500% for a moment, but expect rates to live above 5.500% but below 6.000% for much of the year.

Home Price Appreciation:

2025 was another positive year for some homeowners in our state. Depending on what you own and where you own it, you’ll be either happy or frustrated. While the year-end numbers have not been released, the year-to-date numbers through November showed the following:

Hawaii Island: Single Family Home values were up 0.44%. Condo values were down 3.85%

Kauai: Single Family Home values were down 13.29%. Condo values were up 3.77%

Maui: Single Family Home values were down 0.77%. Condo values were down 22.78%

Oahu: Single Family Home values were up 3.77%. Condo values were down 0.44%

With the numbers above, keep in mind that the values are based on the median sales price. Median is not the average. Median is the statistical middle - meaning an equal number of transactions closed both above and below the median price.

For 2026 I see each island showing a slight gain of 2% to 3% in median home prices due to lower interest rates and more buyers looking for homes. The only HUGE exception is condo sales on Maui. Now that Bill 9 has been signed into law, I see the Maui condo market getting worse before it gets better. There will be some that panic sell. The key to what’s Maui’s condo market bottom will be determined by how much interest will come from those willing to take a gamble on the future of short-term vacation rentals on Maui.

While gains of 2%-3% might seem small for the rest, on a $1-million dollar home, that’s a gain in equity of $20,000 to $30,000. Not shabby.

Legality of Maui’s Bill 9:

A week hadn’t even elapsed before the first lawsuit was filed against the County of Maui challenging the legality of Bill 9. The lawyers did a really good job retracing the history of short-term vacation rentals on Maui. In my opinion, every claim in the suit brought on behalf of the owners of units in the Kaanapali Royal was accurate. The county openly approved and re-approved those condos for short-term rentals fro decades.

Despite the county saying yes all those years, government (Federal, State, or County) has the power of eminent domain, and can rezone property at any time. My prediction is that the courts will uphold the legality of Bill 9. But that doesn’t mean the condo owners get screwed. The owners suffered a loss due to the down-zoning of their property. That loss must be made whole by the government entity that created it. In this case, I predict the courts will find in favor of the owners and award damages equal to their losses – provided they can document those losses. Maui County will fight and appeal as far as they can go to avoid having to out to condo owners rightfully hurt. Those payouts could amount to over $1-billion dollars. Maui County, start saving your nickels.

Green Fee for Cruise Ships:

Governor Green and the state legislature imposed new impact fees on Tourists starting this past New Year’s Day. One of the income streams is to impose the state’s Hotel Room Tax on each utilized cruise ship cabin docking in Hawaii. I had predicted that any competent federal judge would rule that part of the law invalid because there’s federal law that prohibits states from imposing taxes on certain maritime activities – and cruise ships is one of them. To my surprise (maybe not), last week a federal judge denied the request of the cruise industry to block the state from collecting the tax. Then out of nowhere, the 9th Circuit Court of Appeals, the most liberal circuit in the country, overruled the lower court, and blocked the state from collecting the tax.

My prediction is that the courts will find that provision of the Green tax grab violates federal law and will get tossed.

Gambling in Hawaii:

Citing President Trump as evil and blaming him and a Republican congress for cutting federal funding to Hawaii as the source of Hawaii’s budget shortfall, a legalized gambling bill will quietly make its way through the legislature (as it does every session). Instead of looking at all the wasteful spending our state government is guilty of, they’ll cite the funding cuts from the Feds to justify finally passing legalized gambling in Hawaii.

I predict in 2026 that the state legislature will pass a law allowing Hawaii to join the multi-state lottery system as the first step in legalizing gambling here. I will further predict that by 2030, after studying the effects of the lottery on the citizenry, that the state will issue its first license for a casino in Waikiki.*

* I ran this prediction by my friend Miles, and he thought I was wrong about the casino being in Waikiki. His idea makes total sense, and I am going to run with it. I stand corrected. Thanks, Miles! By 2030 the first license for casino gambling will be issued to the Office of Hawaiian Affairs for a casino at the former Fisherman’s Wharf property on the makai-side of Ala Moana Blvd. That is the site where OHA was denied once again the ability to build high rise condos. OHA will follow the model of the American Indian reservations to utilize gambling as a source of revenue for those with Hawaiian lineage.

Population:

This will be a quick and simple prediction. The current official population in the State of Hawaii is 1,446,146. When the official census data is released in July 2026, Hawaii will see a net decrease in population from 2025 to 2026. With it being so hard to live in paradise, is it still a prediction when everyone agrees with you?

These were not just “shoot from the hip” predictions. I did a lot of research and asked many industry experts their thoughts on what to expect in 2026. It was a fun exercise. It will be interesting to see a year from now how accurate the above predictions were. If you want one last prediction that is totally off the wall, in 2026 Taylor Swift will announce she is pregnant! No, I am not a swifty – just something I believe will happen. Let’s all wish for 2026 to be the best year ever for all of us.

And now the week’s economic news…….

A Quiet Week

With a lack of major economic news, the final couple of weeks of the year were relatively quiet for mortgage markets. While recent data suggests that economic growth remains on track, consumers are concerned about the outlook for the new year. Mortgage rates ended just slightly higher.

The latest confidence survey published by the Conference Board revealed that consumers remain worried about the economic outlook and the impact of higher tariffs. In December, the index unexpectedly dropped to the lowest level since the new tariffs in April. The decline was steepest among younger and lower-income consumers. In particular, the outlook for future labor market conditions weakened.

The latest confidence survey published by the Conference Board revealed that consumers remain worried about the economic outlook and the impact of higher tariffs. In December, the index unexpectedly dropped to the lowest level since the new tariffs in April. The decline was steepest among younger and lower-income consumers. In particular, the outlook for future labor market conditions weakened.

Gross Domestic Product (GDP) is the broadest measure of economic activity. Delayed nearly two months by the government shutdown, the report released this week covers the period from July through September, making this data fairly backward-looking. During the third quarter of 2025, U.S. GDP grew at an annualized rate of 4.3%, up from 3.8% in the second quarter, and well above the consensus forecast for an increase of 3.2%. This was the strongest expansion since the third quarter of 2023. Economists from one firm estimated that nearly 70% of the growth came from spending related to Artificial Intelligence and household consumption. Consumer spending rose by a solid 3.5% in the third quarter following a 2.5% increase in the second quarter. Strength was also seen in government spending and exports.

The latest data on home prices from the Federal Housing Finance Agency was encouraging for buyers struggling with affordability. In October, average home prices were just 1.7% higher than a year ago, the smallest annual price increase since March 2012. The report from Case-Shiller released this week ran very close to FHFA’s report. The difference in the two reports is that FHFA only reports on properties with a mortgage that is at or under the conforming loan limit. Case-Shiller looks at all homes in an area, regardless of mortgage amount or if purchased with all cash. That means that the FHFA report tends to track lower priced homes, versus Case-Shiller that captures everything in the target markets they analyze.

The latest data on home prices from the Federal Housing Finance Agency was encouraging for buyers struggling with affordability. In October, average home prices were just 1.7% higher than a year ago, the smallest annual price increase since March 2012. The report from Case-Shiller released this week ran very close to FHFA’s report. The difference in the two reports is that FHFA only reports on properties with a mortgage that is at or under the conforming loan limit. Case-Shiller looks at all homes in an area, regardless of mortgage amount or if purchased with all cash. That means that the FHFA report tends to track lower priced homes, versus Case-Shiller that captures everything in the target markets they analyze.

Next Week

Looking ahead, investors will continue to monitor comments from Fed officials for hints about future monetary policy. For economic reports, the ISM national manufacturing sector index will be released on Monday and the services sector index on Wednesday. The JOLTS report on job openings also will come out on Wednesday. The key Employment report will be released on Friday, and these figures on the number of jobs, the unemployment rate, and wage inflation are always closely watched.

Until next week….

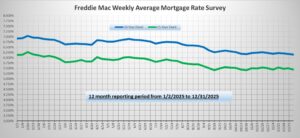

*** Please note that Freddie Mac publishes their weekly rate report on Wednesday mornings from data received Monday and Tuesday.

The graph above is intended to shown rate trends, and not “today’s current rate”. ***

Reviews From Our Past Clients

With every client, we promise to provide you with a comprehensive analysis of your mortgage needs, the best service possible, and the best rates we can find. We make it our mission to have every transaction close with our clients happy with the service we provided. Browse through the hundreds of reviews we’ve received from our clients posted on both Google and Zillow.com, and read what they thought of their experience using Hawaii Mortgage Company.

Google Link:

Hawaii Mortgage Company Review on Google.com

Zillow.com Link:

Hawaii Mortgage Company Reviews on Zillow.com

Our Rate Quote System is Available to You

Our automated rate quoting system is live. Now you can check rates and try different scenarios 24-hours a day. Remember, it’s just a computer. For non-standard rate quotes, such as construction, vacant land, and other specialty programs, you’ll still need to give a call.

Here’s the link: https://www.hawaiimortgage.net/todays-rates/

Do you think all lenders are the same?

There is a difference when you use Hawaii Mortgage Company for your financing. Here’s a short video telling you why:

Broker vs. Banker?

Click the link below to get a quick lesson on why working with a Mortgage Broker will benefit you on your next transaction.