Compliments of

President | NMLS #: 297154

Hawaii Mortgage Company, Inc.

Company NMLS #: 232582

Alan Van Zee is one of the top producing Mortgage Originators in the state, originating over $2,000,000,000 to date. He has written and published this weekly newsletter for the past 18 years. It is the most widely read mortgage, real estate, and finance publication in Hawaii.

Hawaii Mortgage Company, now in our 26th year of providing mortgages to the people of Hawaii, is proud to have a complaint-free history. We make sure our clients are happy!

News and Insight

For the Weekend of January 10th, 2026

Hawaii’s Most Read Mortgage, Real Estate, and Finance Publication for 18 Years

Volume 18 – Issue 16

Your Plan for 2026

Did you stay on the sidelines in 2024 and 2025 wishing to buy a home but were waiting for interest rates to drop? How did that work out for you? Since 2024 home prices have moved higher, yet mortgage rates have stayed stubbornly high.

On January 10th of 2024 the average 30-Year Fixed rate was 6.62%. On January 8th, just a few days ago, the average rate was 6.16%. In that same period, home prices throughout the state rose on average 5%-8%. Let’s compare how that waiting strategy worked out for you using the following scenario.

Home purchase price is $550,000.

Your down payment is 10% or $55,000.

Your mortgage is $500,000.

For a mortgage balance of $500,000 at 6.62% the principal & interest payment would be $3,200. Had the interest rate been where it is today at 6.16%, the payment would be $3,049. That drop of roughly ½ percent equals a savings of $151 per month. In our fantasy scenario, that 24-month savings would equal $3,624.

If you had purchased that $550,000 home in early 2024 and using the low range of appreciation of 5%, that home today would be worth $606,375. That’s an increase in equity of $56,375.

When faced with the facts, it would have been significantly better for you financially to have bought the home in 2024, even with higher rates. That gain in equity would also benefit a refinance now that rates are lower. Without putting an additional dime into having a smaller mortgage balance, you would now have sufficient equity to remove mortgage insurance (remember you put only 10% down). If you purchase today, you’d still be putting only 10% down, and would have mortgage insurance to pay on top of the principal & interest.

Don’t make the same mistake in 2026!

If you listen to those that say real estate is headed for a big correction, you’ll just miss out again. Yes, more homes are coming on the market, but interest rates are continuing to drop. As rates drop, more people can qualify and compete against you for your home. That competition will help keep prices up – not burst any bubble.

If you listen to those that say real estate is headed for a big correction, you’ll just miss out again. Yes, more homes are coming on the market, but interest rates are continuing to drop. As rates drop, more people can qualify and compete against you for your home. That competition will help keep prices up – not burst any bubble.

Even if you are not ready to submit that offer today, today is the day you should start preparing. If you follow these 5 easy steps, it will put you in the best position to achieve homeownership in 2026. If you are a parent, forward this to your adult kids.

Reducing Your Debt:

Inflation and the cost of living hit everyone, even high earners. There’s nothing to be ashamed of having used credit cards to live during the last couple of years. But now is the time to reverse that habit.

Buying a home will in almost all cases increase your monthly expenses over renting. Maybe not much, but it will be higher. If you are living off credit now, how would you afford a larger housing expense? You need to examine your expenses. If homeownership is truly a goal, that daily Starbucks or daily purchased lunch at work adds up to a lot of money each month. Take lunch from home. And is a $6.00 coffee on the way to work really that important? Ironically, that $6.00 expense is almost equal to the mortgage interest savings I started off with today.

Saving for a Larger Down Payment:

If you are fortunate enough to have kept your debt relatively low, you can really help your ability to buy a home by squeezing more out of your take home income to save for your down payment. Yes, there are programs that allow low down payments, but the more you can put down, the better the terms and payment. You’d be surprised to see how being able to put just 3.5% down versus zero will open more doors. The same is true for being able to put 5% down versus just 3.5%. The mortgage insurance premiums drop considerably with 10% down versus 5%. And yes, the same is true with 15% down versus 10%. And obviously with 20% down, MI is not required.

Saving for Closing Costs:

Outside of your down payment, it will cost you anywhere from about $4,000 to $10,000 depending on the price of the home you are buying. Sure, you can try and negotiate for the seller to credit you to cover those costs, but is the seller really paying them?

Let’s say you put in an offer on a house listed for $575,000. If your offer was $550,000 plus $10,000 in closing costs, that offer is really $540,000. If the seller wanted to net $550,000, they would counter your offer at $560,000 with the credit – netting them $550,000. If you accept that offer, who is really paying the closing cost credit? You!

Credit Scores:

This tip ties directly to reducing your debt from #2 above. High balances on credit cards are the number one reason for low credit scores. You’d be surprised at how much your scores will jump by paying down those balances. Even if you can’t pay them off, a balance less than 50% of the credit limit will see your scores jump higher.

Getting Pre-Approved (early):

Since I’m the person you’ll come to for your pre-approved, I cannot emphasize this enough. Even if you are 6-9 months out, being proactive is better than being surprised when you’re ready to seriously hunt for homes. Having a professional review of your income, assets, and credit early will provide you with the best opportunity to make adjustments, get errors fixed, and plan accordingly as to how much home you can afford.

No athlete jumps out on the field without practice. You should treat the biggest purchase of your life the same way. Consider the pre-approval process as your financial practice sessions. Maybe your credit needs more attention… You get my point. The point is to do this early before you go 100% forward. You’ll know your strengths and weaknesses.

2026 should be the year you finally make buying a home a reality. If you use the 5-points above as a starting point, you’ll get more home, a better rate, smaller payments, and be happy you did all the hard work prior to starting the process. Looking through listings and deciding and which property to offer is the easy part. The real work happens long before you sign that offer contract.

Another Suit Filed Against Bill 9

Just a quick note that a second suit has been filed in court in an attempt to stop Maui’s Bill 9 from being enforced. This time the suit is a class action suit for all owners of units on the Minatoya list. If you own one of those units, you most likely haven’t gotten a notice yet if you want to join the class. The suit was filed with 5 members – the minimum needed to file a class action suit.

Once the court recognizes the legitimacy of the class, the attorneys can send out solicitations for others to join in the litigation.

In an interesting conversation I had with a top real estate agent on Maui this week, I shared my thoughts that the county has the right to down-zone property but must then pay owners for their loss in value. I estimated that bill may exceed $1-billion dollars. What shocked me was that is seems people like Maui Mayor Richard Bisson are all too happy to make that trade-off. If Maui has to pay a billion dollars in damages, the residents of Maui will foot that bill in higher taxes for decades.

Why not seek bonds for one billion dollars and build homes instead? That way Maui can keep on having more tourism and help residents become homeowners at the same time. The answer is simple – it takes smart leadership.

Accepting Darwinism

I’m a dad and I’m getting old. In east Oahu where I live, despite changes in the law, the crazy kids are still riding their e-bikes recklessly and zooming around popping wheelies without a care in the world. I’ve tried to be the cool dad and stopped them and talked with them. I shared that when I was young(er) I did a lot of crazy stuff too. But the attitude I get back is so disrespectful I’ve decided to change my tune.

I realize that back in my day some kids did some really foolish stuff and paid the price for it. The kids of today are no different. Except when I was a kid, we didn’t have access to motorized bikes capable of reckless speeds.

Trying to be a good uncle doesn’t work with this younger generation. 50 years ago, you heard people say, “where’s their parents?” Funny, that’s what came to my mind this week seeing a pair of wheelie masters going 40 mph down the road with that front wheel up in the air.

Darwinism is survival of the fittest. Let’s be honest, some of these kids won’t see the age of 21. No law is going to save them. For parents unsure of their kids’ adventures outside their purview; if you were concerned and bought them a motorcycle helmet, they are most likely using that e-bike like a motorcycle.

And now the week’s economic news…….

MBS Purchase Plan

Surprisingly, the big news this week for mortgage markets was not the Employment report. Instead, the announcement that the government will purchase large quantities of MBS caused a nice rally at the end of the week, and mortgage rates ended lower.

On Thursday, President Trump said that the government will purchase $200 billion of mortgage-backed securities (MBS). Few details about the plan are known at this point, but its goal is to lower mortgage rates and make housing more affordable. The potential for added demand for MBS caused their yields to decline and thus mortgage rates to show some relief.

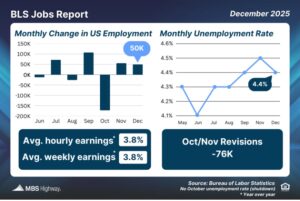

The Employment report revealed that the economy added 50,000 jobs in December, below the consensus forecast of 60,000. Average job gains in 2025 were just 49,000 per month, down from 168,000 in 2024. The unemployment rate unexpectedly fell to 4.4%, below the consensus forecast of 4.5%. Average hourly earnings, an indicator of wage growth, were 3.8% higher than a year ago, up from an annual rate of 3.6% last month.

The Employment report revealed that the economy added 50,000 jobs in December, below the consensus forecast of 60,000. Average job gains in 2025 were just 49,000 per month, down from 168,000 in 2024. The unemployment rate unexpectedly fell to 4.4%, below the consensus forecast of 4.5%. Average hourly earnings, an indicator of wage growth, were 3.8% higher than a year ago, up from an annual rate of 3.6% last month.

The latest JOLTS (job openings and labor turnover rates) report, covering the month of November, caught investors by surprise. At the end of November, there were just 7.15 million job openings, far below the consensus forecast of 7.60 million and the fewest in more than a year. Hardest hit this month were the leisure/hospitality, health care, and social assistance sectors. A smaller number of openings suggests that companies face less pressure to raise wages to hire enough workers, a sign of weakness for the labor market.

Two other significant economic reports released this week by the Institute of Supply Management revealed mixed results. The ISM national services sector index rose to 54.4, well above the consensus forecast, to the highest level of the year. Meanwhile, the national manufacturing sector index unexpectedly fell to just 47.9, the lowest level since October 2024. Readings above 50 indicate an expansion in the sectors and below 50 a contraction. This was the tenth straight month that the manufacturing index was under 50, while the services index has generally held above that level. The higher tariffs on foreign goods imposed last year may provide a lift to domestic manufacturing companies over time and help close the performance gap with services.

Next Week

Looking ahead, investors will continue to monitor comments from Fed officials for hints about future monetary policy. For economic reports, the Consumer Price Index (CPI), a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services, will come out on Tuesday. Retail Sales will be released on Wednesday. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key measure of the health of the economy. Existing Home Sales also will come out on Wednesday.

Until next week….

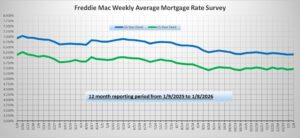

*** Please note that Freddie Mac publishes their weekly rate report on Wednesday mornings from data received Monday and Tuesday.

The graph above is intended to shown rate trends, and not “today’s current rate”. ***

Reviews From Our Past Clients

With every client, we promise to provide you with a comprehensive analysis of your mortgage needs, the best service possible, and the best rates we can find. We make it our mission to have every transaction close with our clients happy with the service we provided. Browse through the hundreds of reviews we’ve received from our clients posted on both Google and Zillow.com, and read what they thought of their experience using Hawaii Mortgage Company.

Google Link:

Hawaii Mortgage Company Review on Google.com

Zillow.com Link:

Hawaii Mortgage Company Reviews on Zillow.com

Our Rate Quote System is Available to You

Our automated rate quoting system is live. Now you can check rates and try different scenarios 24-hours a day. Remember, it’s just a computer. For non-standard rate quotes, such as construction, vacant land, and other specialty programs, you’ll still need to give a call.

Here’s the link: https://www.hawaiimortgage.net/todays-rates/

Do you think all lenders are the same?

There is a difference when you use Hawaii Mortgage Company for your financing. Here’s a short video telling you why:

Broker vs. Banker?

Click the link below to get a quick lesson on why working with a Mortgage Broker will benefit you on your next transaction.