Compliments of

President | NMLS #: 297154

Hawaii Mortgage Company, Inc.

Company NMLS #: 232582

Alan Van Zee is one of the top producing Mortgage Originators in the state, originating over $2,000,000,000 to date. He has written and published this weekly newsletter for the past 18 years. It is the most widely read mortgage, real estate, and finance publication in Hawaii.

Hawaii Mortgage Company, now in our 26th year of providing mortgages to the people of Hawaii, is proud to have a complaint-free history. We make sure our clients are happy!

News and Insight

For the Weekend of January 24th, 2026

Hawaii’s Most Read Mortgage, Real Estate, and Finance Publication for 18 Years

Volume 18 – Issue 18

We Have a Critter Problem

Growing up in Hawaii we all learned of the horrors we would face if the brown tree snake ever made its way to our islands. Guam’s native bird population is gone. But Hawaii faces much more destructive pests that could not only damage our economy but make our home an unpleasant place to live.

We’ve all heard about the Coconut Rhinoceros Beetle (CRB). It amazes me that despite being warned that this pest could wipe out all the coconut trees in Hawaii, then move to other plants to feast, our government has taken such a mild stance on trying to eradicate it. Our legislature will allocate billions of dollars this session, but very little will be earmarked to stop this invasive pest. Maybe our elected officials don’t care much about coconut trees?

But then I read this week how we are losing the war against an even bigger threat - the Little Fire Ant. Are you even aware that our islands are facing this problem? Little fire ants are considered one of the worst invasive species in the world, known for their painful sting and ability to form “super-colonies” of millions of ants that overwhelm other species of insects. Brooke Mahnken, a former fire ant coordinator for the Maui Invasive Species Committee in an interview with Civil Beat said, “Once they establish and their population starts growing, they will infest every square inch in the three-dimensional space. “When that happens, it’s an incredible loss of biodiversity. Almost everything else is killed or eaten or driven out.”

But then I read this week how we are losing the war against an even bigger threat - the Little Fire Ant. Are you even aware that our islands are facing this problem? Little fire ants are considered one of the worst invasive species in the world, known for their painful sting and ability to form “super-colonies” of millions of ants that overwhelm other species of insects. Brooke Mahnken, a former fire ant coordinator for the Maui Invasive Species Committee in an interview with Civil Beat said, “Once they establish and their population starts growing, they will infest every square inch in the three-dimensional space. “When that happens, it’s an incredible loss of biodiversity. Almost everything else is killed or eaten or driven out.”

Scared yet? Here’s the scary part. Each island has formed a group to help stop invasive species, but the funding from our state and local government is minimal.

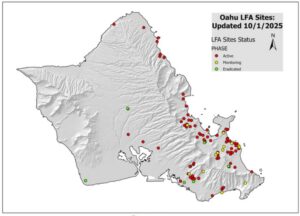

Maybe you don’t care because it hasn’t affected you yet. Maybe you don’t go outside much and noticed. When I checked the most recent map for infestations on Oahu, I was shocked to see how widespread this pest has become.

While the map may not look so threatening, each of those red dots are in areas reported by people. They may be in areas where people are not around to report on seeing them. Little Fire Ants don’t like people, and they don’t like our pets wandering into their newly conquered territory. LFA are dangerous. At a minimum, you don’t want to be stung by one (or 100).

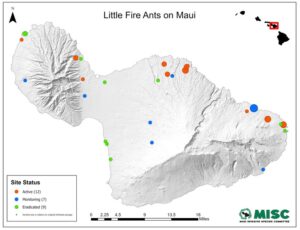

Oahu is by far the most impacted, but Maui is also impacted island-wide. For Maui, since the island is less densely populated, the extent of the problem could be hidden. Unless someone encounters LFA, their existence in an area will be unknown.

How does this all circle back to real estate? Would YOU want to buy a home in an area invaded by LFA? How would an LFA infestation affect your home’s value? Now do you see the potential impact?

For the billions our state spends each year in the budget, why would they ignore the issue of invasive species? It is time we pressured our legislators to put our hard-earned money to good use. Call your representative and senator today and tell them to increase funding to eradicate LFA. This is one battle we can’t afford to wait to see what happens.

And now the week’s economic news…….

Greenland

Surprisingly, the biggest influences on mortgage markets this week were comments from President Trump about Greenland. Major inflation data delayed by the government shutdown matched expectations and caused little reaction. The Greenland news was mildly negative for mortgage rates, which ended the week slightly higher.

On Tuesday, President Trump said that the acquisition of Greenland was important for US national security and threatened to impose additional tariffs on countries preventing this from happening. Many European countries were strongly opposed, and one small investment fund in Denmark sold its holdings of US bonds in protest. Concern that this might be just the tip of the iceberg and much larger selling might take place caused US bond yields to rise, including mortgage rates. However, yields reversed and moved lower on Wednesday when President Trump ruled out the use of military force or tariffs to acquire Greenland.

Fed officials keep a close eye on inflation, and the PCE price index is their favored indicator. In November, Core PCE was 2.8% higher than a year ago, up from an annual rate of increase of 2.7% in October and matching the consensus forecast. Progress toward the 2.0% target of the Fed has not been easy, and this desired level has not been achieved since February 2021.

Fed officials keep a close eye on inflation, and the PCE price index is their favored indicator. In November, Core PCE was 2.8% higher than a year ago, up from an annual rate of increase of 2.7% in October and matching the consensus forecast. Progress toward the 2.0% target of the Fed has not been easy, and this desired level has not been achieved since February 2021.

The Department of Labor releases the total number of new claims for unemployment insurance each week. The latest reading was just 200,000, below the consensus forecast. The four-week moving average, an indicator that helps smooth out volatility, was just 201,500, the lowest level in two years. Bigger picture, this was far below the inflated figures seen during the early months of the pandemic, and in line with the levels which were typical during 2019. Weekly jobless claims are important because they are one of the timeliest indicators of labor market trends. While other recent economic reports suggest that companies may be scaling back on hiring new employees, this report indicates that they remain reluctant to lay off workers.

It was another good week for mortgage applications, especially for refinancing, according to the Mortgage Bankers Association. Applications to refinance surged 20% from last week and were a massive 183% higher than one year ago. Purchase applications rose 5% from the prior week and were up 18% from last year at this time.

Next Week

Looking ahead, investors will continue to monitor comments from government officials about Greenland. The next Fed meeting will take place on Wednesday. No change in the federal funds rate is anticipated, and investors will be hoping for clues about the outlook for future monetary policy. For economic reports, Consumer Confidence will be released on Tuesday. The Producer Price Index (PPI), a monthly inflation indicator, is scheduled for Friday.

Until next week….

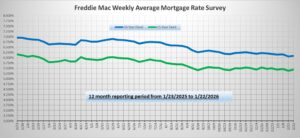

*** Please note that Freddie Mac publishes their weekly rate report on Wednesday mornings from data received Monday and Tuesday.

The graph above is intended to shown rate trends, and not “today’s current rate”. ***

Reviews From Our Past Clients

With every client, we promise to provide you with a comprehensive analysis of your mortgage needs, the best service possible, and the best rates we can find. We make it our mission to have every transaction close with our clients happy with the service we provided. Browse through the hundreds of reviews we’ve received from our clients posted on both Google and Zillow.com, and read what they thought of their experience using Hawaii Mortgage Company.

Google Link:

Hawaii Mortgage Company Review on Google.com

Zillow.com Link:

Hawaii Mortgage Company Reviews on Zillow.com

Our Rate Quote System is Available to You

Our automated rate quoting system is live. Now you can check rates and try different scenarios 24-hours a day. Remember, it’s just a computer. For non-standard rate quotes, such as construction, vacant land, and other specialty programs, you’ll still need to give a call.

Here’s the link: https://www.hawaiimortgage.net/todays-rates/

Do you think all lenders are the same?

There is a difference when you use Hawaii Mortgage Company for your financing. Here’s a short video telling you why:

Broker vs. Banker?

Click the link below to get a quick lesson on why working with a Mortgage Broker will benefit you on your next transaction.