Compliments of

President | NMLS #: 297154

Hawaii Mortgage Company, Inc.

Company NMLS #: 232582

Alan Van Zee is one of the top producing Mortgage Originators in the state, originating over $2,000,000,000 to date. He has written and published this weekly newsletter for the past 18 years. It is the most widely read mortgage, real estate, and finance publication in Hawaii.

Hawaii Mortgage Company, now in our 26th year of providing mortgages to the people of Hawaii, is proud to have a complaint-free history. We make sure our clients are happy!

News and Insight

For the Weekend of February 7th, 2026

Hawaii’s Most Read Mortgage, Real Estate, and Finance Publication for 18 Years

Volume 18 – Issue 20

People are Leaving in Record Numbers

They say New York City is a tough place to live. Housing costs in NYC are almost always at the top of the list for being the most expensive city to live in, in the US. And New Yorkers wear that badge with honor by singing “if I can make it there, I’ll make it anywhere” a line from New York, New York. But there’s another metric for NYC that helps the 8-million people live there - higher wages.

Hawaii also ranks at the top of the list for high housing costs. Yet Hawaii can’t boast the same about higher wages. Hawaii’s residents are growing tired of the daily struggle to keep a roof over their head and food on the table.

For those that are truly in poverty, they lack the financial ability to effectuate any change in their circumstances. They are like survivors of a shipwreck on a raft adrift on the ocean. They are at the mercy of government to be the rain to provide barely enough water to survive and charitable causes to be the occasional fish that jumps onto the raft.

Then there’s the vocal group that has turned to using Hawaiian sovereignty and the overthrow of the monarchy to demand “social” and “economic” justice. Oddly, begging at the feet of our state legislators puts them in a position no different than the shipwrecked group, except their raft has provisions so they won’t starve.

The largest group caught up in Hawaii’s high cost of living are sadly the perpetual renters who placate their inability to own a home by spending what money they have on overly expensive vehicles. This is not the middle class of the mainland. There, this group would own a small starter home, and over time build equity to trade up to something bigger and nicer to meet the needs of a growing family.

The last group, unhappy with the constant struggle to survive here, made the decision to vote with their feet and moved to the mainland. This is not a phenomenon unique to Hawaii. People have realized that while the grass may not be greener in other places, it is significantly cheaper. We’re a small state, and while the numbers aren’t as large as states with millions of residents, the percentage of Hawaii residents that decided to pack it up, puts us again at the top of another list.

The chart below from the US Census Bureau ranks Hawaii #4 in net migration of residents as a percentage of its population. That means that despite thousands moving to Hawaii each year, over the past five years, we’ve still managed to see 60,000 more people leave than arrive. If you were to chart just the number of residents leaving, the number would be significantly higher than 60,000.

The chart lists winner and loser states in terms of net population gain or loss. On the loser side all the states except Alaska subject their residents to the highest tax burdens in the country. The list makes it clear that higher taxes will force people to move. The data also shows that low taxes don’t play as crucial a role as where they move to.

Civil Beat published an interesting essay recently about Zippy’s opening their fourth location in the Las Vegas area. Lee Cataluna wrote:

“For all the hand-wringing about Hawaiʻi residents moving away to places like Las Vegas so they can afford a nice house and send their kids to fancy schools like Bishop Gorman to play football, the deeper truth is that a lot of Hawaiʻi people enjoy the move. They may bring bits of home with them, like a small plumeria tree to grow in the back yard, but itʻs not at all a bad choice for many people. Hawaiʻi is a place that is easy to love but hard to live in. You can either be dearly homesick for the islands or nearly homeless trying to raise a family here.”

I believe those words to be very true. Moving to the mainland isn’t a sign one has lost the battle or shunning Hawaii’s culture. Moving to a locale with higher paying jobs and a lower cost of living is smart. Beaches and great weather can only offset the bad stuff so much.

But for those groups I highlighted above, those without the means to pack it up and leave, our elected officials owe them their best work to make Hawaii easier to live in. Doing nothing while our core population exits to another state is no way to make Hawaii better. It is a surefire path to eliminate the middle class and leave only the poor and affluent. That is not a very good mix for peaceful tranquility.

It is true that with thousands leaving Hawaii, home price pressure is reduced. Unfortunately, regular folk can’t compete against mainland retirees able to pay cash or make substantial down payments on expensive homes here. It’s not because those mainlanders are evil or ignore the culture, this group has spent their lives building wealth and can afford higher home prices. There’s no way a young couple just starting off can compete against that.

For those either staying by choice or can’t escape, the only way things are going to get better is with better representation in our local government, both state and county. It’s a recurring theme, but I will press you on it every chance I get:

Stop electing the same people.

Now is a great opportunity to spend just a few minutes, a couple of days a week, reviewing what’s going on at that big square building on Beretania Street while our state legislature is in session. It’ll be over in May. Learn what issues our elected body is trying to tackle by finding out the legislation they propose. You’ll find they waste a lot of time holding hearings. And despite the testimony and committee votes on a measure, it will all get secretly changed in a backroom meeting near the end of the session.

And now the week’s economic news…….

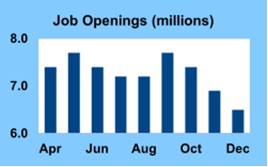

Job Openings Plunge

The major economic data released this week was mixed, but investors focused a little more on labor market weakness than on strength in other areas such as manufacturing. As a result, mortgage rates ended the week slightly lower.

The latest JOLTS (job openings and labor turnover rates) report, covering the month of December, caught investors by surprise. At the end of December, there were just 6.5 million job openings, far below the consensus forecast of 7.2 million and the lowest level since September 2020. A smaller number of openings suggests that companies face less pressure to raise wages to hire enough workers, a sign of weakness for the labor market.

The latest JOLTS (job openings and labor turnover rates) report, covering the month of December, caught investors by surprise. At the end of December, there were just 6.5 million job openings, far below the consensus forecast of 7.2 million and the lowest level since September 2020. A smaller number of openings suggests that companies face less pressure to raise wages to hire enough workers, a sign of weakness for the labor market.

Another component of the JOLTS report revealed that the layoff rate was 1.1%, roughly unchanged from a year ago. However, separate data from a large outplacement firm indicated that layoffs soared in January. Planned job cuts increased sharply from December to the highest level for the month of January since 2009 and were up 118% from the same period one year ago.

In contrast to the labor market data, two significant economic reports released this week from the Institute of Supply Management revealed stronger than expected results. The ISM national manufacturing sector index jumped to 52.6, far above the consensus forecast of 48.5 and the highest level since August 2022. Readings above 50 indicate an expansion in the sectors and below 50 a contraction. The ISM national services sector index fell slightly to 53.8, but this still exceeded the consensus forecast. The higher tariffs on foreign goods imposed last year may be providing a lift to domestic manufacturing companies and helping them close the performance gap with services.

In contrast to the labor market data, two significant economic reports released this week from the Institute of Supply Management revealed stronger than expected results. The ISM national manufacturing sector index jumped to 52.6, far above the consensus forecast of 48.5 and the highest level since August 2022. Readings above 50 indicate an expansion in the sectors and below 50 a contraction. The ISM national services sector index fell slightly to 53.8, but this still exceeded the consensus forecast. The higher tariffs on foreign goods imposed last year may be providing a lift to domestic manufacturing companies and helping them close the performance gap with services.

After a very strong start to the year, bad winter weather finally halted the momentum for mortgage applications, according to the Mortgage Bankers Association. Applications to refinance declined 5% from last week but still were a massive 117% higher than one year ago. Purchase applications fell 14% from the prior week and were up 4% from last year at this time.

Next Week

Looking ahead, investors will continue to monitor comments from Fed officials for hints about future monetary policy. Delayed a bit by the recent government shutdown, the key Employment report will be released on Wednesday, and these figures on the number of jobs, the unemployment rate, and wage inflation are always closely watched. Existing Home Sales will come out on Thursday. The Consumer Price Index (CPI), a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services, will come out on Friday.

Until next week….

*** Please note that Freddie Mac publishes their weekly rate report on Wednesday mornings from data received Monday and Tuesday.

The graph above is intended to shown rate trends, and not “today’s current rate”. ***

Reviews From Our Past Clients

With every client, we promise to provide you with a comprehensive analysis of your mortgage needs, the best service possible, and the best rates we can find. We make it our mission to have every transaction close with our clients happy with the service we provided. Browse through the hundreds of reviews we’ve received from our clients posted on both Google and Zillow.com, and read what they thought of their experience using Hawaii Mortgage Company.

Google Link:

Hawaii Mortgage Company Review on Google.com

Zillow.com Link:

Hawaii Mortgage Company Reviews on Zillow.com

Our Rate Quote System is Available to You

Our automated rate quoting system is live. Now you can check rates and try different scenarios 24-hours a day. Remember, it’s just a computer. For non-standard rate quotes, such as construction, vacant land, and other specialty programs, you’ll still need to give a call.

Here’s the link: https://www.hawaiimortgage.net/todays-rates/

Do you think all lenders are the same?

There is a difference when you use Hawaii Mortgage Company for your financing. Here’s a short video telling you why:

Broker vs. Banker?

Click the link below to get a quick lesson on why working with a Mortgage Broker will benefit you on your next transaction.