Compliments of

President | NMLS #: 297154

Hawaii Mortgage Company, Inc.

Company NMLS #: 232582

Alan Van Zee is one of the top producing Mortgage Originators in the state, originating over $2,000,000,000 to date. He has written and published this weekly newsletter for the past 17 years. It is the most widely read mortgage publication in Hawaii.

Hawaii Mortgage Company, now in our 25th year of providing mortgages to the people of Hawaii, is proud to have a complaint-free history. We make sure our clients are happy!

Mortgage Market News and Insight

For the Weekend of March 15th, 2025

Hawaii’s Most Read Mortgage Publication for 17 Years

Volume 17 – Issue 26

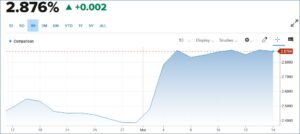

Treasury Secretary’s Plan for Lower Mortgage Rates and to Unfreeze Housing

No one knows better than your friendly neighborhood real estate agent or mortgage broker that mortgage interest rates are too high and have remained that way for far too long a period. It was music to the ears of us mortgage people in an interview this week with our US Treasury Secretary Scott Bessent, he addressed mortgage rates and his desire to drive them lower to jumpstart an ailing housing market.

While a lot of the information in this article may be too narrow in focus, it is an interesting read to learn just how the actions our government takes, makes a profound impact on housing and mortgages. Therefore, if you own a home and are thinking of selling, thinking of buying, or in need of a refinance, learn today our government’s plan to get mortgage rates lower. Lower mortgage rates allow more people to qualify. More buyers with a lack of inventory will promote higher home prices. Yes, today’s newsletter is important.

If you’ve read my newsletter for any length of time, you’ve learned that mortgage rates are driven by many factors. Mortgages, no different than stocks on Wall Street, need investors to buy them to provide the pool of money every lender uses to fund your mortgage. Mortgage rates are set by the price investors are willing to pay for Mortgage Backed Securities (MBS) they represent. That price is dictated by the laws of supply and demand. I’ll try to not dive too deep into the weeds trying explain our current situation, and how Bessent will try and steer a new course.

Competing Investments:

Mortgage bonds track closely with other competing bond offerings. Mainly MBS competes with US issued bonds, primarily the 10-Year Note. For every dollar our government spends that exceeds what we’ve collected in taxes, the US must issue bonds to cover that shortfall. Since covid, our government has increased spending significantly. That has resulted in record amounts of US treasuries going to market. With the flood of supply and steady to diminished demand, it forced the government to pay higher yields (bond rates) to those willing to buy them. As the rates for US treasuries increased, that affected the investors willing to buy MBS. MBS rates needed to increase as well, to attract buyers. That’s just one reason why mortgage rates have increased dramatically in the past 3 years.

There’s also foreign competition for investors that buy bonds. Traditionally, the US has been the big spender in the world. We are not only the most charitable country, but we supplement the security of nations around the globe. The Trump administration wants to significantly reduce the amount we contribute worldwide to lower our deficit. That will require others to pick up the slack. The European Union announced on March 4th they have agreed in principal to fund $800-Billion Euros in new defense spending to make up for the US’s actions. That large amount of spending – not even approved yet, sent rates for the German equivalent to our US 10-Year Note (The German 10-Year Bund) to jump 22.5% overnight.

Investors are global. We have to think of all this sovereign debt around the world as one pot of supply. When investors decide they want to buy German debt versus US debt, it will reduce demand for US debt and MBS. That will require US debt to offer a higher rate to attract buyers.

Inflation:

Why is it that if the price of food goes up that affects mortgage rates? Because inflation really isn’t adjusting the price you pay for things, it really is the devaluation of our currency. If the dollar is worth less, it will cost more dollars to buy the same item. US and MBS bonds are traded in dollars. If the value of the dollar is reduced, the underlying value of the bond drops as well. If you go to the bank and buy a 5-year savings bond with a face value of $100 and keep it for those 5 years, you’ll get your $100 back, plus the interest promised. If the value of the dollar has dropped in those 5 years, that $100 plus interest is worth a smaller amount today than it was 5 years ago.

The bond traders are not going to get taken advantage of by inflation. They will not buy bonds in inflationary times unless the rate offered is high enough to cover the inflation forecast.

Money Supply and Inflation:

This I will try and explain as simple as possible. Supply & demand. We face inflation right now because during the past few years our country expanded the supply of money. Yes, we created dollars out of thin air. While this created more dollars, it reduced its value at the same time. We issued debt to expand the money supply, then gave our citizens a lot of it to spend. We increased the demand side of things, while at the same time had a reduced supply of goods due to the pandemic.

Inflation wouldn’t have been so bad, except we needed to use those now “reduced in value dollars” to buy things internationally – specifically oil. As the price of oil shot up (surprise! Oil is traded in US dollars) it put upward pressure on all goods and services in the US.

The Treasury Secretary’s Tools:

Secretary Bessent said in that interview this week that he wants to unlock the housing market by driving mortgage rates lower. Here are the tools he can use to get us there:

Reduce the Balance in the General Account:

The Treasury General Account (TGA) is the U.S. government's primary operating account, held at the Federal Reserve, where tax payments, proceeds from Treasury securities, and government disbursements are managed. It's used for all major financial transactions of the U.S. government, including receiving tax payments and other revenues and tax receipts, plus proceeds from the sale of Treasury securities. The TGA is also used to pay Social Security benefits, salaries, interest on the national debt, and other government expenses.

Right now, the TGA has a balance of nearly $600-Billion dollars. Instead of issuing more debt (bonds) by the government, they could draw down a portion of the balance and reduce the supply of bonds hitting Wall Street. Reducing bond offerings by as little as $30-Billion each month for the next 10 months, will help bring down mortgage rates. Leaving a running balance in the government’s checking account of around $300-Billion would bring it back to a healthy pre-pandemic level.

Balance Sheet Reinvestment:

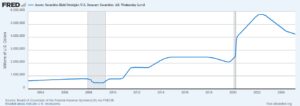

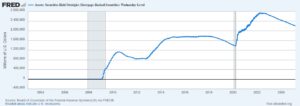

The Federal Reserve buys US debt issued by the Treasury and also buys mortgages from Fanie Mae and Freddie Mac. The Fed holds TRILLIONS of dollars of both treasury notes and MBS. As you can see from the two graphs below, the Fed’s peak in holdings took place in 2022. In an effort to keep rates low during covid, the Fed purchased record amounts of US and MBS debt in 2020-2022. They artificially increased the demand to compensate for increased supply. That move by the Fed is what resulted in the lowest interest rates we’ve ever seen.

Since the peak in 2022, the Fed has let expiring debt roll off their balance sheet. How does debt expire? The Fed purchases US notes in various maturities; 3-Month, 6-Month, 1-Year, 2-Year, 10-Year, and 30-Year. For example, if they purchased $75-Billion in 2-Year notes in April of 2023, those notes will mature next month. Upon maturity the Treasury will pay back the $75-Billion bought by the Fed and that amount comes off the ledger above. The same is true for MBS when someone refinances or sells their home with a Fannie Mae or Freddie Mac mortgage. When that mortgage note is paid off it is subtracted from the Fred’s balance sheet.

What the Fed has done in the past to help interest rates is to roll those proceeds into new buying new US Treasuries and MBS. It doesn’t hurt the Fed to keep the same level of bonds on its ledger. By creating an additional $30-Billion to $40-Billion in additional bond purchases each month, that additional demand will also work to bring rates down.

Issuance:

Jumping back to the supply side of things, when our government spending exceeds revenue, that’s when we issue bonds. As I stated earlier in this article, bonds come in various maturity periods. It’s the job of the Treasury Secretary to decide what maturity length of bond to issue to cover the debt. Our former Treasury Secretary Janet Yellen did a real bonehead thing early on in the Biden administration. With interest rates at historic lows, she decided to issue the shortest maturity bonds for the massive amount of debt, instead of locking in the low rates at the time with longer term bonds. As those shorter period bonds matured, the Treasury needed to issue new bonds to cover that debt, since it wasn’t being paid back. As each new issuance period came, rates were higher than before. Each new bond offering was at higher rates than the previous bonds. The interest payments on our national debt would be significantly lower today if the debt had been locked in at just over 1%, versus 4%-plus we are paying now.

The reverse is true today with rates near their peak. The Treasury Secretary will issue shorter-term bonds versus longer maturity bonds. This will benefit us in two ways. First, taking advantage of the discount a shorter maturity offers, it will reduce the interest payments the government will have to make on our national debt. And second, by not issuing a lot of the longer term bonds, like the 10-Year Note, it will reduce supply in the supply & demand battle. With less supply, rates will drop.

If you made it this far, give yourself an A+ for weekend economics 401 - certainly an upper-level course!

If Secretary Bessent follows through with all of the above, which can be summed up simply by saying he wants to reduce the supply of bonds flooding the market, that alone will drive interest rates down. But sadly, unless we as a country get our financial home in order and stop spending more that we collect, debt will continue to be issued at record amounts, and rates will remain elevated.

I’ll optimistically keep my fingers crossed.

And now the week’s economic news…….

Inflation Eases

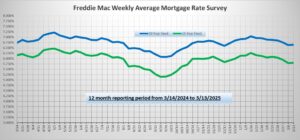

The major inflation data released this week was weaker than expected. There was surprisingly little reaction in mortgage markets however, and rates ended the week nearly unchanged.

The Consumer Price Index (CPI) is one of the most closely watched inflation indicators released each month. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors look at core CPI, which excludes food and energy. In February, Core CPI was 3.1% higher than a year ago, below the consensus forecast and the lowest annual rate since April 2021.

The Consumer Price Index (CPI) is one of the most closely watched inflation indicators released each month. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors look at core CPI, which excludes food and energy. In February, Core CPI was 3.1% higher than a year ago, below the consensus forecast and the lowest annual rate since April 2021.

Although this annual rate is down significantly from a peak of 6.6% in September 2022, and from 3.9% in January of last year, it is still far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. Shelter (housing) costs continue to be a primary reason why further progress on bringing down inflation remains challenging. In addition, used car prices, apparel, and auto insurance posted large increases in February, while airline fares dropped sharply.

Another significant inflation indicator released this week, which measures costs for producers, also came in well below the expected levels. The February core Producer Price Index (PPI) fell 0.1% from January, far below the consensus forecast for an increase of 0.3%. It was 3.4% higher than a year ago, down from an annual rate of 3.6% last month. Of the two major inflation reports, investors tend to place less weight on PPI, since it reflects a smaller slice of the economy than CPI.

The lower rates seen in recent weeks helped boost mortgage applications. According to the latest data from the Mortgage Bankers Association (MBA), applications to refinance jumped 16% from last week and were a massive 90% higher than one year ago (that’s 90% higher from next to zero!). Purchase applications rose 7% from the prior week and were up a little from last year at this time.

Next Week

Investors will continue to watch for additional information about tariff policies. The next Fed meeting will take place on Wednesday. No change in the federal funds rate is expected, and investors will be looking for additional guidance on future monetary policy decisions. For economic reports, Retail Sales will be released on Monday. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key measure of the health of the economy. Housing Starts will come out on Tuesday and Existing Home Sales on Thursday.

Until next week….

*** Please note that Freddie Mac publishes their weekly rate report on Wednesday mornings from data received Mondays and Tuesdays. The graph above is intended to shown rate trends, and not “today’s current rate”. ***

Reviews From Our Past Clients

With every client, we promise to provide you with a comprehensive analysis of your mortgage needs, the best service possible, and the best rates we can find. We make it our mission to have every transaction close with our clients happy with the service we provided. Browse through the hundreds of reviews we’ve received from our clients posted on both Google and Zillow.com, and read what they thought of their experience using Hawaii Mortgage Company.

Google Link:

Hawaii Mortgage Company Review on Google.com

Zillow.com Link:

Hawaii Mortgage Company Reviews on Zillow.com

Our Rate Quote System is Available to You

Our automated rate quoting system is live. Now you can check rates and try different scenarios 24-hours a day. Remember, it’s just a computer. For non-standard rate quotes, such as construction, vacant land, and other specialty programs, you’ll still need to give a call.

Here’s the link: https://www.hawaiimortgage.net/todays-rates/

Do you think all lenders are the same?

There is a difference when you use Hawaii Mortgage Company for your financing. Here’s a short video telling you why:

Broker vs. Banker?

Click the link below to get a quick lesson on why working with a Mortgage Broker will benefit you on your next transaction.