Compliments of

President | NMLS #: 297154

Hawaii Mortgage Company, Inc.

Company NMLS #: 232582

Alan Van Zee is one of the top producing Mortgage Originators in the state, originating over $2,000,000,000 to date. He has written and published this weekly newsletter for the past 18 years. It is the most widely read mortgage, real estate, and finance publication in Hawaii.

Hawaii Mortgage Company, now in our 26th year of providing mortgages to the people of Hawaii, is proud to have a complaint-free history. We make sure our clients are happy!

News and Insight

For the Weekend of November 22nd, 2025

Hawaii’s Most Read Mortgage, Real Estate, and Finance Publication for 18 Years

Volume 18 – Issue 11

Eliminating Property Taxes

Both Florida and Texas are advancing proposals to eliminate property taxes for homestead lots. The simple definition of a homestead lot is one where the property is the owner’s principal place of residence. Those in favor of eliminating property taxes see these taxes as a forever debt to the government. They believe that your homestead is something sacred, and as such, taxes on that type of property are unjust. In Hawaii, we enjoy relatively low property taxes compared to other metropolitan cities. Maybe that’s why you don’t hear too much complaining about them.

The reason Florida is pushing to eliminated property taxes is to help carve out a benefit for one particular group of people – senion citizens. And to be perfectly honest, Florida has a lot of them – and they are active voters. Doing something to benefit an active voting base is good for business – the political business. In Florida, like so many other states, property values over the past few years have jumped considerably. That has not only resulted in significant gains in equity, but big jumps in the corresponding property taxes owed. Many senior citizens living on fixed incomes are now finding it difficult to pay those elevated taxes. An argument can be made that forcing seniors to sell and move on because of increased taxes is bad for society. That’s where the push to eliminate property taxes came from.

California took a different path to combat escalading property taxes in 1978 when voters passed Proposition 13. Prop 13 capped the general property-tax rate at 1 % of the assessed value at acquisition, rolled back assessed values to the 1975-76 level for tax purposes, and thereafter limited annual increases in assessed value to no more than 2 % per year, unless there’s a change in ownership.

The results of Prop 13 now in its 4th decade are not ideal. It seems that capping property taxes has created a “locked-in” effect. Knowing that when you sell and then subsequently buy another home, you’ll lose those super low property taxes, disincentivizes people from moving. When those people stay put, that stops the process I wrote about last week where people buy starter homes, then buy and sell to meet their growing needs until possibly downsizing in retirement. Each one of those steps frees up a home where those earlier in their life journey can acquire your former home. The lock-in effect has helped drive California home prices to some of the highest in the country. Economists believe Prop 13 has added an additional 20% to home prices due to scarcity of homes for sale.

Both Florida’s idea of eliminating property taxes and California’s severely restricted property taxes through Prop 13 may help some citizens in one way but unfairly penalize others with even higher taxes. Why Hawaii has low property taxes is exactly the reason eliminating or restricting property taxes is a bad idea.

Governments need to collect tax dollars to meet their budgets. If they don’t get them from property taxes they must find the revenue elsewhere. And where they decide to tax to make up for that shortfall will usually benefit someone while unfairly burdening someone else. If Florida does away with property taxes, where will the revenue come from? Will they increase sales taxes? If so, younger people spend a greater proportion of their income that is subject to sales taxes. So are the poorest in our communities. In Florida, if done wrong, Gen Z could be burdened with more taxes to benefit Boomer retirees – the most affluent in society.

Tax collection is a shell game the government plays trying to hide how much they collect from any one source, so those citizens impacted don’t complain too much. While politicians proclaim holding taxes at current levels on the one hand, they are hiking taxes with the other hand.

In Hawaii, government has grown incredibly fast in the past decade. More of the tax burden is being shifted to tourism. OHA now wants a slice of the tourist market by requesting the legislature add their own fee to the hotel room tax. I caution our politicians. Las Vegas, thought by many to be a tourism titan where tourist numbers increase each year, is now facing uncharacteristic financial ruin. Why? Going to Vegas got too expensive for most. The golden goose can only lay so many eggs. At some point, like Las Vegas today, that the goose got eaten.

The only reason property taxes in Hawaii are relatively low, compared to mainland areas, is how the tax burden is allocated. Most places on the mainland, a portion of your property taxes goes towards paying for public schools in your area. That’s not what we do here. The clever way Hawaii has made the central state government collect most of the taxes has done two things. First, it has made the counties dependent on the state. Second, it has decoupled taxpayers from seeing their tax dollars in action close to home.

Anyone catch the story this week about Kealakehe Elementary School on the Big Island with their ongoing water and sewer leaks at this aging school? Teachers have complained for years of leaks soiling classrooms and restrooms forced to be closed due to water pipes being shut off. If residents that send their kids to that school paid property taxes to fund the school, the residents would never put up with such disgusting dereliction of maintenance. The reporting captured the sentiment perfectly from the teaches themselves and the parents – “oh well, what can we do, it’s run by the state.”

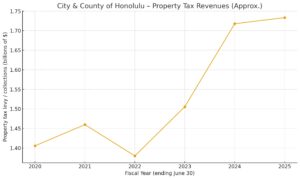

The way property taxes in Hawaii are charged also is a great way for politicians to claim fighting for us while taking more of our money. Property taxes are based on a percentage of the value of your property then taxed at a specific rate. I can’t remember the last time Honolulu raised property tax rates, yet every year they collect more money. It’s a wonderful scheme. The politicians can claim they aren’t raising our taxes, yet they get to collect more money.

Since property taxes on based on value, as our homes increase in value, unless the tax rate is reduced, the government wins by collecting more money. If Hawaii were to adopt a hybrid plan, it would force our elected leaders to come to us each year and tell us they need to collect more money. Right now, they get away without asking because the formula is baked into the system.

Should states eliminate property taxes – no. Should property taxes get scrutinized better and a system developed to force elected leaders to not spend more because our property values increase – yes.

Maui Vacation Condo Update

Bill 9, the controversial bill to downzone thousands of units on the “Minatoya List” is headed for a final vote in December. Of the nine-member council 4 members are for the bill, while 4 are against it. One member, Tasha Kama – who was against the bill, past away unexpectedly. The remaining 8 council members have until Tuesday November 25th to choose a replacement for Kama, otherwise the choice gets handed to the mayor, who is wholly in favor of Bill 9.

The council has 3 possible choices. One candidate is for Bill 9, one is against Bill 9, and the third hasn’t formally made a decision. One candidate was the replacement choice from Kama herself before her death. The second ran against Kama in the last election and lost to her. Will an evenly split council be unable to choose a replacement, thus giving the mayor the ultimate pick? Whatever the outcome, expect the final vote on Bill 9 in December and a fresh batch of lawsuits filed quickly after. Drama!

And now the week’s economic news…….

Employment Report

With the end of the shutdown, the flow of key government economic data has gradually resumed, beginning with the delayed Employment report for September. This labor market data was mixed, and the reaction was slightly positive for mortgage markets. As a result, rates ended the week a little lower.

The Employment report revealed that the economy added 119,000 jobs in September, above the consensus forecast of 50,000. Strength was seen in health care, leisure/hospitality, and social assistance. However, the unemployment rate increased from 4.3% to 4.4%, the highest level since October 2021. Average hourly earnings were 3.8% higher than a year ago, up from an annual rate of 3.7% last month.

The Employment report revealed that the economy added 119,000 jobs in September, above the consensus forecast of 50,000. Strength was seen in health care, leisure/hospitality, and social assistance. However, the unemployment rate increased from 4.3% to 4.4%, the highest level since October 2021. Average hourly earnings were 3.8% higher than a year ago, up from an annual rate of 3.7% last month.

Of note, the release date for the next Employment report is scheduled for December 16, after the Fed meeting on December 10. Recent comments from Fed officials about future monetary policy have varied greatly, and investors remain nearly evenly split about whether the Fed will reduce the federal funds rate by another 25 basis points at this meeting.

In October, sales of existing homes rose slightly from September, close to expectations, to the highest level in eight months. Sales were 2% higher than a year ago. The median price of $415,200 was up 2% from last year at this time. Inventories remain stuck at low levels, standing at just a 4.4-month supply nationally. However, inventories were 11% higher than a year ago. First-time buyers represented 32% of sales, up from 27% a year ago.

In October, sales of existing homes rose slightly from September, close to expectations, to the highest level in eight months. Sales were 2% higher than a year ago. The median price of $415,200 was up 2% from last year at this time. Inventories remain stuck at low levels, standing at just a 4.4-month supply nationally. However, inventories were 11% higher than a year ago. First-time buyers represented 32% of sales, up from 27% a year ago.

The latest survey of home builder sentiment on housing market conditions from the NAHB unexpectedly rose from 37 to 38, the highest level since April. However, the index remained in negative territory below 50 for the nineteenth straight month. According to the NAHB, 41% of builders reported cutting prices as an incentive to attract buyers, the highest level since the pandemic. Builders said that uncertainty about tariffs and rising costs made it more difficult to price their homes.

Next Week

Looking ahead, investors will continue to watch for additional information about tariffs and monitor comments from Fed officials for hints about monetary policy later in the year. With the end of the shutdown, investors will be waiting for updates to the schedule for the release of government economic reports. The September Producer Price Index (PPI), a monthly inflation indicator, is scheduled for Tuesday. New Home Sales is scheduled for Wednesday. MBS markets will be closed on Thursday and will close early on Friday.

Until next week….

*** Please note that Freddie Mac publishes their weekly rate report on Wednesday mornings from data received Monday and Tuesday.

The graph above is intended to shown rate trends, and not “today’s current rate”. ***

Reviews From Our Past Clients

With every client, we promise to provide you with a comprehensive analysis of your mortgage needs, the best service possible, and the best rates we can find. We make it our mission to have every transaction close with our clients happy with the service we provided. Browse through the hundreds of reviews we’ve received from our clients posted on both Google and Zillow.com, and read what they thought of their experience using Hawaii Mortgage Company.

Google Link:

Hawaii Mortgage Company Review on Google.com

Zillow.com Link:

Hawaii Mortgage Company Reviews on Zillow.com

Our Rate Quote System is Available to You

Our automated rate quoting system is live. Now you can check rates and try different scenarios 24-hours a day. Remember, it’s just a computer. For non-standard rate quotes, such as construction, vacant land, and other specialty programs, you’ll still need to give a call.

Here’s the link: https://www.hawaiimortgage.net/todays-rates/

Do you think all lenders are the same?

There is a difference when you use Hawaii Mortgage Company for your financing. Here’s a short video telling you why:

Broker vs. Banker?

Click the link below to get a quick lesson on why working with a Mortgage Broker will benefit you on your next transaction.