Compliments of

President | NMLS #: 297154

Hawaii Mortgage Company, Inc.

Company NMLS #: 232582

Alan Van Zee is one of the top producing Mortgage Originators in the state, originating over $2,000,000,000 to date. He has written and published this weekly newsletter for the past 17 years. It is the most widely read mortgage publication in Hawaii.

Hawaii Mortgage Company, now in our 25th year of providing mortgages to the people of Hawaii, is proud to have a complaint-free history. We make sure our clients are happy!

Mortgage Market News and Insight

For the Weekend of April 5th, 2025

Hawaii’s Most Read Mortgage Publication for 17 Years

Volume 17 – Issue 29

Maui Needs to Decide on a Path Forward

When economic times are good, everyone gets along fine. When a community is faced with hardship, that is when you really learn how everyone truly feels about their neighbors. The Lahaina wildfire has exposed long-held beliefs of many that feel wronged - dating back to the monarchy.

The best remedy for the effects of the Lahaina fire would be for things to get back to the way they were as quickly as possible. Lives were lost, many lost everything they owned. A return to normalcy is the antidote. But a battle has emerged over the future of Lahaina that has entangled the future of Maui as a whole. That battle is the battle over tourism.

The best remedy for the effects of the Lahaina fire would be for things to get back to the way they were as quickly as possible. Lives were lost, many lost everything they owned. A return to normalcy is the antidote. But a battle has emerged over the future of Lahaina that has entangled the future of Maui as a whole. That battle is the battle over tourism.

Maui’s politicians have finally decided to let people rebuild their homes as they were. But the debate on commercial activity is just getting started. If every home lost were to be rebuilt tomorrow, what would all those residents do without a job?

It’s a fairy tale to believe Lahaina will be rebuilt quickly. Maui’s mayor and county council recognize that. But the path they wish to take to fix Maui’s long standing housing shortage, and ignoring the commercial future of Maui may take the island’s economy in a negative direction. The new housing being fast-tracked are rentals. And the mayor is still threatening to revoke the ability of over 7,000 condo units (Minatoya List) to be rented on a short-term basis.

Two recent reports should cause great concern for those wishing to push the future of Maui away from tourism.

First, the Realtor’s Association of Maui’s February sales report on condos paints a chilling picture of sluggish sales. Listings down, pending sales volume has crashed, closed sales took a dive, and days on the market almost doubled.

For those unfamiliar with Maui’s condo market, the vast majority of units are geared towards tourism. The units are mostly in resorts areas not conducive to long-term occupancy. When you talk about condo sales on Maui, it goes hand-in-hand with the strength of tourism. Talk to any real estate agent on Maui today and they’ll tell you people from the mainland are deciding against Maui. They feel unwelcome, they are worried about the viability of an investment being taken from them, and they are concerned that a major portion of Maui’s tourism draw, Lahaina, is gone – and may not return.

The second report came out this week from the University of Hawaii’s Economic Research Organization (UHERO). That report studied the effects of phasing out short-term vacation rentals on Maui. Here’s the link to the report: UHERO STVR Report. I’ll save you some time reading it. It’s not a happy ending. Here are some of the highlights:

- Total visitor spending is projected to decline by $900 million annually

- The decline in spending also results in the loss of 1,900 jobs

- Property tax revenues could fall by up to $60 million annually

- GET and TAT tax revenues are projected to fall by a combined $15 million annually

What happens when you take roughly $1 billion dollars out of Maui’s economy? We already have an example of that to look forward to. It’s called Molokai. The residents of Molokai have made their feelings of tourism and foreign investment very clear. While Molokai has resisted development, one aspect of life there has increase – poverty. Did you know that 45% of the residents on the “Friendly Isle” live at or below 200% of the poverty line? What does that mean? 45% of Molokai’s residents make less than $28,870 annually. News of life on Molokai is rarely heard. There are no real economic opportunities on Molokai. Residents have the choice to stay and live on a beautiful, underdeveloped island in the United States with a depressed economy, or leave their home.

Maui needs to realize that the goose that laid the golden egg is being hunted by the politicians while simultaneously being scared away by groups that believe tourism ruined Maui. If you take away the economic engine, the island will fall into depression. Instead, Maui should start a marketing campaign to welcome tourists back. They should abandon plans to reclassify condos serving tourism. Maui needs to encourage investment, not threaten it.

Maui needs to push for more affordable homes people can purchase, not rent. Renters never benefit from appreciation. Allow someone to get into a starter home, and you’ve put them on the home appreciation escalator to enrich their life. Keep someone as a renter, and the likelihood they’ll prosper is doubtful.

Maui, stop playing class warfare. You need tourists. You need investors to own and rent out short term vacation rentals. They are not the reason there’s a housing shortage and record high cost of living. Look no further than the politicians you’ve elected that have failed you. Instead of using the tax revenues of tourism to benefit and uplift Maui’s residents, they’ve squandered it away with little to show.

The choice is yours. Maui can recover and once again be one of the jewels of tourism destinations, or slowly decay economically. Pick your path and your leaders wisely.

And now the week’s economic news…….

Tariffs

Investors were focused on tariffs this week. Higher tariffs reduced the outlook for global economic growth, which was positive for mortgage markets and negative for stocks. The major economic data caused little reaction. As a result, mortgage rates ended the week at their lowest levels since October.

On Wednesday afternoon, President Trump announced that tariffs will be increased for many countries. China quickly responded by raising tariffs on U.S. goods. The direct effect on mortgage rates is that higher tariffs will raise prices, adding to current inflation levels. However, investors anticipate that this negative influence will be more than offset by the resulting reduction in global economic growth, which will reduce future inflationary pressures. Longer-term, the impact of higher tariffs will be determined by their magnitude and duration, which likely will depend on the outcome of negotiations with other countries.

The key Employment report revealed that the economy gained 228,000 jobs in March, well above the consensus forecast of 140,000. Revisions reduced job gains for both January and February totaled $48,000 – making March’s number close to expectations. Sectors displaying strength included health care, retail, and transportation. The unemployment rate increased from 4.1% to 4.2%. Average hourly earnings, an indicator of wage growth, were 3.8% higher than a year ago, down from an annual rate of 4.0% last month.

The key Employment report revealed that the economy gained 228,000 jobs in March, well above the consensus forecast of 140,000. Revisions reduced job gains for both January and February totaled $48,000 – making March’s number close to expectations. Sectors displaying strength included health care, retail, and transportation. The unemployment rate increased from 4.1% to 4.2%. Average hourly earnings, an indicator of wage growth, were 3.8% higher than a year ago, down from an annual rate of 4.0% last month.

Two other significant economic reports released this week by the Institute of Supply Management fell short of expectations. The ISM national services sector index dropped to 50.8, well below the consensus forecast of 53.0 and the lowest level since June 2024. The national manufacturing index declined to 49.0, also below the consensus. Readings above 50 indicate an expansion in the sectors and below 50 a contraction. Service companies continue to outperform manufacturers.

In a speech on Friday, Chair Powell said that the Fed faces a "highly uncertain outlook" because of the new tariff policies, which are expected to raise inflation and lower economic growth. He explained that one challenge for the Fed is determining whether the tariffs will cause a "one-time increase" in the price level or an "ongoing inflation problem." As a result, Powell concluded that officials would need to wait and see the effects of the tariff policies to decide the appropriate path for future monetary policy. Investors currently anticipate that the Fed will reduce the federal funds rate in June.

Next Week

Investors will continue to look for additional information about tariff policies. For economic reports, the main event will be CPI on Thursday. The Consumer Price Index (CPI) is a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services. The Producer Price Index (PPI), another monthly inflation indicator, will be released on Friday.

Until next week….

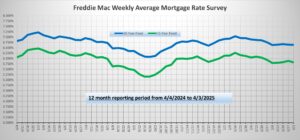

*** Please note that Freddie Mac publishes their weekly rate report on Wednesday mornings from data received Monday and Tuesday.

The graph above is intended to shown rate trends, and not “today’s current rate”. ***

Reviews From Our Past Clients

With every client, we promise to provide you with a comprehensive analysis of your mortgage needs, the best service possible, and the best rates we can find. We make it our mission to have every transaction close with our clients happy with the service we provided. Browse through the hundreds of reviews we’ve received from our clients posted on both Google and Zillow.com, and read what they thought of their experience using Hawaii Mortgage Company.

Google Link:

Hawaii Mortgage Company Review on Google.com

Zillow.com Link:

Hawaii Mortgage Company Reviews on Zillow.com

Our Rate Quote System is Available to You

Our automated rate quoting system is live. Now you can check rates and try different scenarios 24-hours a day. Remember, it’s just a computer. For non-standard rate quotes, such as construction, vacant land, and other specialty programs, you’ll still need to give a call.

Here’s the link: https://www.hawaiimortgage.net/todays-rates/

Do you think all lenders are the same?

There is a difference when you use Hawaii Mortgage Company for your financing. Here’s a short video telling you why:

Broker vs. Banker?

Click the link below to get a quick lesson on why working with a Mortgage Broker will benefit you on your next transaction.