Compliments of

President | NMLS #: 297154

Hawaii Mortgage Company, Inc.

Company NMLS #: 232582

Alan Van Zee is one of the top producing Mortgage Originators in the state, originating over $2,000,000,000 to date. He has written and published this weekly newsletter for the past 17 years. It is the most widely read mortgage publication in Hawaii.

Hawaii Mortgage Company, now in our 25th year of providing mortgages to the people of Hawaii, is proud to have a complaint-free history. We make sure our clients are happy!

Mortgage Market News and Insight

For the Weekend of April 19th, 2025

Hawaii’s Most Read Mortgage Publication for 17 Years

Volume 17 – Issue 31

Mortgage Fraud

Last October I wrote about two types of fraud in real estate, fraud for financial gain, and fraud for housing. Within the last month two well-known politicians have been accused of mortgage fraud, specifically fraud for housing. Today we’ll review the rules and see what these politicians have been accused of. It will not only be entertaining, but you’ll learn what you’re not allowed to do. This is not political. It just burns me - and it should anger you as well, that those in power get away with things you and I would be found guilty of in a heartbeat.

Fraud for housing, also known as fraud for property, is a type of mortgage fraud where borrowers intentionally misrepresent information on a loan application to secure a mortgage, often to obtain a better loan or even gain ownership of a home. This type of fraud typically involves the borrower as the perpetrator and may include misrepresenting income, assets, liabilities, or occupancy.

Adam Schiff

Adam Schiff has been a US Congressman for many years representing California. In November he won a statewide election to become the junior US Senator for the golden state.

Schiff owns a beautiful 3,280 sqft home in Maryland – an easy commute to Washington D.C. He also owns a 650 sqft condo in Burbank California. The problem, Schiff claims owner-occupancy on the condo in Burbank while also claiming owner-occupancy for the Maryland home. Schiff gets a property tax break on the condo because of his claim of owner-occupancy, but has also profited by obtaining more favorable mortgage terms the 3 times he’s refinanced his Maryland home.

Schiff must claim a California property as his primary residence to fulfill his residency requirement, otherwise he is disqualified to represent his state in DC. He can’t claim both places as his primary residence. Either he lives in Maryland, and can’t fulfill his California residency requirement, or he claims the Burbank condo as his primary residence, but can no longer benefit financially by claiming the Maryland home as his primary residence.

You can’t have it both ways.

Letitia James

A publication uncovered documentation about real estate transactions for the New York Attorney General that has spawned a criminal referral to the DOJ to investigate. The documentation that’s been released is pretty damning against the NY AG.

In the referral from FHFA, the government agency that controls Fannie Mae and Freddie Mac, they focus on two properties owned by James. The first is a Brooklyn multi-unit brownstone. This is a picture of the property. It has a basement, plus 3 additional floors. The top floor is split into two separate units. The NYC Department of Buildings’ certificate of occupancy says the building has 5 units, but James has repeatedly claimed the property has only 4 units. What’s the big deal? Fannie and Freddie do not fund 5+ unit properties because anything over 4 units is considered commercial. Without the fraud, James would have needed to find less desirable commercial financing. Not only did she obtain financing fraudulently, but she also applied and received a favorable loan modification under the HAMP (Home Affordable Modification Program) offered to Fannie and Freddie residential properties.

In the referral from FHFA, the government agency that controls Fannie Mae and Freddie Mac, they focus on two properties owned by James. The first is a Brooklyn multi-unit brownstone. This is a picture of the property. It has a basement, plus 3 additional floors. The top floor is split into two separate units. The NYC Department of Buildings’ certificate of occupancy says the building has 5 units, but James has repeatedly claimed the property has only 4 units. What’s the big deal? Fannie and Freddie do not fund 5+ unit properties because anything over 4 units is considered commercial. Without the fraud, James would have needed to find less desirable commercial financing. Not only did she obtain financing fraudulently, but she also applied and received a favorable loan modification under the HAMP (Home Affordable Modification Program) offered to Fannie and Freddie residential properties.

The second property is a single-family home in Virginia. That property was purchased by James and her niece in 2023. The source of financing for this property also came from Fannie and Freddie.

In that transaction, James signed a notarized declaration that the property would be her primary residence. What makes this this truly egregious is that James, an attorney, knows better than us folk about the consequences of lying in relation to a federal mortgage application. James also knows that a requirement to be the Attorney General for the State of New York is that she must reside in the state. Claiming residency in another state would render her no longer qualified to be NY AG. If there was any doubt a fast one was pulled here, the document was witnessed by the First Deputy Attorney General, Jennifer Levy. Another lawyer that should know better.

James and her niece benefitted by obtaining a lower owner-occupant rate than buying as a second home or investment property. They also benefitted from a smaller down payment requirement for owner-occupants.

And in one other extremely bizarre claim in the criminal referral, FHFA documented how James, in 1983 at age 25, bought a home with her dad, by claiming him to be her husband. They refinanced the property in 2000 with the same claim of marriage.

In the end, nothing will happen to Senator Schiff. The statute of limitations has run out on the mortgage portion of his fraud. His last refinance transaction in Maryland was in 2013. If you’re wondering, the statute of limitations for mortgage fraud is 10 years.

For New York AG James, she is in deep kimchee. In her case, it’s not a matter of “he said, she said”, the signed documents say it all.

It doesn’t matter who you are or the position you have in life, everyone should play by the same rules. There’s no justification for the rich or powerful to be allowed to play by a different set of rules than the ones we are held to. That includes fraud for housing. Don’t do it – it’s not worth it.

Penalties for housing fraud, especially mortgage fraud, can be severe, including fines, imprisonment, and restitution. Federal mortgage fraud convictions can lead to up to 30 years in prison and a $1,000,000 fine. Additionally, individuals may face a federal felony criminal record and be required to pay back the amount of money defrauded.

If We’re All Guilty, Maybe the Law is Wrong?

I will openly admit that often I exceed the posted speed limit when driving. Not by much, but still not th posted limit. It was the story in the news this week about the traffic cameras and the amount of speeders the state has caught that made me pause and think.

On Oahu, the State installed traffic cameras at key intersections in 2023 to cut down on the amount of collisions due to people running red lights. A year and a half later we learned that with a click of the mouse, those same cameras measure and site people for speeding. Before announcing to the public their plan, the State ran tests to see how many infractions they caught with people exceeding the speed limit by 5-7 mph. They never made public those results. Instead, they announced that the new program would only site drivers that were going 11 mph over the speed limit. During the introductory phase, motorists are sent a warning notice with no fine. A nice way to make the public aware of their behaviors.

On Oahu, the State installed traffic cameras at key intersections in 2023 to cut down on the amount of collisions due to people running red lights. A year and a half later we learned that with a click of the mouse, those same cameras measure and site people for speeding. Before announcing to the public their plan, the State ran tests to see how many infractions they caught with people exceeding the speed limit by 5-7 mph. They never made public those results. Instead, they announced that the new program would only site drivers that were going 11 mph over the speed limit. During the introductory phase, motorists are sent a warning notice with no fine. A nice way to make the public aware of their behaviors.

The results for March 2025 were astounding! The cameras caught 30,000 people speeding. What’s amazing is that in all of 2024, the Honolulu Police Department issued only 24,000 speeding tickets. That’s right, in one month the cameras caught more speeders from less than 20 intersections than island wide by HPD in the entire previous year. The State Department of Transportation has been forced to extend the grace period because with that amount of violations, the police nor the courts could handle the volume.

This got me thinking. If speeding has become so pervasive in certain areas, maybe the speed limit is wrong and not the drivers?

As a society, we want to keep our roads safe and reduce the number of accidents. If this were the only motivating factor, the speed limit would be 5 mph everywhere. But as a society we realize that we need to get from place to place in a timely manner. To do so we sacrifice some safety for time and efficiency.

From my perspective, the engineers that determined the speed limits for our islands took too conservative an approach. I’m not advocating for 80 mph on the freeway. When you drive around over the course of the next week study your speed and the speed of those around you. In most cases the pace of traffic seems to exceed the posted speed limits everywhere.

Technology has uncovered a dirty little secret, most drivers speed. This year the death toll throughout the state is up, and I’m not sure why. If the state is going to start ticketing speeders using these cameras, they should also study the speed limits. The pace of 360,000 annual speeding tickets proves the system is needs to be reviewed.

And now the week’s economic news…….

Consumer Spending Jumps

It was another volatile week for mortgage markets, as news about tariffs remained the primary focus for investors. Consumer spending revealed the anticipated spike ahead of potentially higher prices. After rising sharply last week, mortgage rates declined.

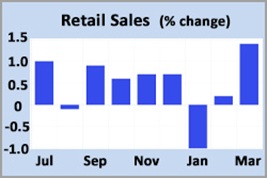

With many consumers rushing to beat possible price hikes due to new tariffs, retail sales in March surged a giant 1.4% from February, close to expectations, and the largest monthly increase since January 2023. Motor vehicle and parts sales posted a massive gain of 5.3% in March. Significant strength was also seen in sporting goods/hobbies and building materials.

With many consumers rushing to beat possible price hikes due to new tariffs, retail sales in March surged a giant 1.4% from February, close to expectations, and the largest monthly increase since January 2023. Motor vehicle and parts sales posted a massive gain of 5.3% in March. Significant strength was also seen in sporting goods/hobbies and building materials.

In the past, a monthly report on import prices from the Bureau of Labor Statistics has generally not received much attention, but investors are keeping a closer eye on it now due to the new tariff policies. Import Prices in March were roughly flat from February, as expected. This is important because import prices are measured before any tariffs are imposed. Investors are trying to determine whether exporters in other countries will lower their prices to at least partially offset higher tariffs or whether U.S. households and businesses will absorb the costs.

In a speech on Wednesday, Chair Powell again suggested that the Fed may face a "challenging scenario" due to the new tariff policies, which are expected to raise inflation and lower economic growth, putting the goals of its dual mandate in conflict. As a result, Powell concluded that officials need to wait and see the effects of the tariff policies to decide the appropriate path for future monetary policy. Investors currently anticipate that the Fed will reduce the federal funds rate in June.

On Thursday, the European Central Bank (ECB) cut benchmark interest rates by 25 basis points. This move was widely anticipated, and the reaction was relatively minor. In its policy statement, the ECB said that the outlook for growth "has deteriorated" due to rising trade issues, and the volatile market response is likely to have a "tightening impact" on financial conditions.

Next Week

Investors will continue to look for additional information about tariff policies. It will be a very light week for economic reports, highlighted by the housing sector data. New Home Sales will be released on Wednesday and Existing Home Sales on Thursday.

Until next week….

*** Please note that Freddie Mac publishes their weekly rate report on Wednesday mornings from data received Monday and Tuesday.

The graph above is intended to shown rate trends, and not “today’s current rate”. ***

Reviews From Our Past Clients

With every client, we promise to provide you with a comprehensive analysis of your mortgage needs, the best service possible, and the best rates we can find. We make it our mission to have every transaction close with our clients happy with the service we provided. Browse through the hundreds of reviews we’ve received from our clients posted on both Google and Zillow.com, and read what they thought of their experience using Hawaii Mortgage Company.

Google Link:

Hawaii Mortgage Company Review on Google.com

Zillow.com Link:

Hawaii Mortgage Company Reviews on Zillow.com

Our Rate Quote System is Available to You

Our automated rate quoting system is live. Now you can check rates and try different scenarios 24-hours a day. Remember, it’s just a computer. For non-standard rate quotes, such as construction, vacant land, and other specialty programs, you’ll still need to give a call.

Here’s the link: https://www.hawaiimortgage.net/todays-rates/

Do you think all lenders are the same?

There is a difference when you use Hawaii Mortgage Company for your financing. Here’s a short video telling you why:

Broker vs. Banker?

Click the link below to get a quick lesson on why working with a Mortgage Broker will benefit you on your next transaction.