Compliments of

President | NMLS #: 297154

Hawaii Mortgage Company, Inc.

Company NMLS #: 232582

Alan Van Zee is one of the top producing Mortgage Originators in the state, originating over $2,000,000,000 to date. He has written and published this weekly newsletter for the past 17 years. It is the most widely read mortgage, real estate, and finance publication in Hawaii.

Hawaii Mortgage Company, now in our 25th year of providing mortgages to the people of Hawaii, is proud to have a complaint-free history. We make sure our clients are happy!

Mortgage Market News and Insight

For the Weekend of July 19th, 2025

Hawaii’s Most Read Mortgage, Real Estate, and Finance Publication for 17 Years

Volume 17 – Issue 43

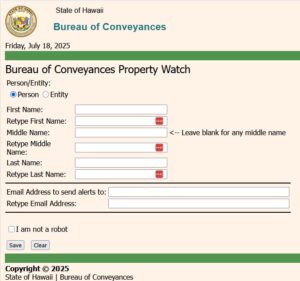

State Offers Help for Title Name Changes

Title theft has been a huge concern and a popular topic for me to write about. In an effort to help consumers, the state has initiated a “Property Watch” registration program. The Bureau of Conveyances has launched a new online service for customers to receive emailed notifications when a specified name is noted as a party in a recorded document.

This system will not prevent fraudulent recordings from occurring. Which is no different than the companies that charge a fee for a similar service.

Here’s how Hawaii’s system works and how it differs from private monitoring services:

The system the state has launched is a database with the names of every person that registers for the service. If the Bureau of Conveyances processes a recorded document with a name that’s in the Property Watch database, the state will send that person an email message that their name popped up on a document. The notification is tied to names in the database, and not property addresses.

That differentiation is what makes the state’s system somewhat ineffective. If you have a common name like James Lee, that name could be tied to 100+ properties. Every James Lee registered in the database will get a notice when any document with the name James Lee is recorded. Those notices are all false positives, except for the one specific James Lee tied to a specific property. If the title of your property has a misspelled name and it doesn’t match the name you entered into the Property Watch database, you won’t get notified.

The commercial companies that offer title monitoring services routinely check your property’s title records. They are address specific. If a change has been made, they notify you as soon as they find out. And again, just like any system available, no one can prevent a fraudulent document being recorded. The commercial services also offer insurance to help pay for legal counsel to fix things.

Is it worth it to register for the state’s free program? If the name on your property title is not very common, it is better than nothing. If you’re a Smith, Lee, or Yamamoto (the most common haole, Chinese, and Japanese names in Hawaii), unless you have an unusual first name or uncommon middle name, you’ll get a lot of false positives from the state. That’s still better than nothing.

To register for the “Property Watch” program, please click here.

Here’s the information screen you’ll see when you use the link above:

New Credit Score System and Credit Tutorial

The cost we pay when we pull your credit report has gotten out of hand. A joint credit report used to cost $40. It’s now almost $140. In an effort to bring in competition and reduce costs, FHFA announced this week that they have approved the use of a competitor to the FICO credit scoring system we are all very familiar with. The goal is with increased competition, the cost to obtain one’s credit will go down.

In multiple studies VantageScore was able to outperform FICO Scores. Let’s do quick recap on how credit scores are generated and the history to better understand how this will impact you.

In the 1950’s engineer Bill Fair and mathematician Earl Isaac developed a system that analyzed how a consumer obtained credit and paid those obligations as a way to predict the likelihood of continued on-time payments if new credit was granted to them. They formed a company called Fair Isacc and Company, better known as FICO. The method uses data collected by the nation’s credit repository companies.

While not required, most companies in the US who issue credit, report your monthly balance and payment history. They report that information to 1, 2, or all 3 credit repositories. The repositories are Equifax, Experian, and TransUnion. The only function of the repositories is to maintain accurate records of your balances and payment history. By the way, the reason we pull credit from all 3 bureaus is because not all credit is reported to all 3.

You are allowed to check once per year at no cost to see what the repositories have on file for you. That annual check will not impact your credit scores. If you want to check your credit history, use this link: https://www.annualcreditreport.com/

Prior to 1989 when you applied for a mortgage the underwriter made an exhausted review of your credit report looking to see if you were “credit worthy”. In 1989 this subjective system was replaced with the FICO credit model system.

When you apply for credit, that company may choose to utilize the FICO credit model system to determine if you’re a good candidate to extend credit to. The FICO credit model is nothing more than a computer program that looks at balances, payment history, length of time you’ve had credit, and if you’ve had any recent attempts to obtain more credit. That analysis spits out your FICO score.

Did you know there are different FICO models depending on the type of credit you are trying to obtain? That’s right. FICO has a scoring model for mortgage financing, one for car loans, a model used for property managers and rentals, even a model for prospective employers to analyze applicants.

How do the two systems stack up against each other?

- VantageScore claims it captures more data and produces a more accurate score than FICO. Remember, FICO and Vantage look at your same raw credit data. The difference is in the computer model.

- VantageScore was often 30 to 40 points higher than FICO Scores for the same individual, especially for people with thin credit files or recent delinquencies.

- About 80% of consumers were in the same general credit tier (e.g., subprime, prime) across both models, but 20% were classified differently.

- VantageScore scored 30–35 million more people than FICO, often due to more lenient data requirements (e.g., it only requires one account reported in the past 6 months, compared to FICO’s 24-month requirement).

- FICO is more conservative and tends to produce lower scores for consumers with recent delinquencies, limited credit history, and high credit utilization.

I welcome competition. Will I switch to Vantage over FICO? If the costs are lower for my clients and produce the same results, sure! But I know that in some situations where a consumer will score better on one system over the other, we may need to pull two reports. Unfortunately, we won’t know until we pull the first report.

Any system that will allow more qualified applicants obtain financing is welcome news to me.

Primary Residences vs Owner-Occupant Financing

This came up again in the news this week as the head of the FHFA, the government entity that oversees Fannie Mae and Freddie Mac, referred a US senator to the justice dept. for possible charges of mortgage fraud. The last time I wrote about this story I was accused of being partisan, so I am leaving out the names and party affiliations. I would rather examine the issue, as it comes up all the time with people coming to me for financing.

While the terminology may seem the same, there’s a huge difference between claiming a primary residence and obtaining owner-occupant financing.

Can you have 2 primary residences? Generally, no, Fannie Mae and Freddie Mac do not allow you to have two primary (owner‑occupied) residences at the same time—each borrower is expected to designate and occupy one principal residence.

Exceptions for a second primary residence loan:

There are certain special situations where Fannie Mae and Freddie Mac can treat a second home as a primary residence:

- Caregiver or family support:

You buy a new home to care for an adult child with a disability, or vice versa. Your lender should allow the second home to qualify as a primary residence. - Non‑occupant co‑borrower/co‑signer arrangement:

If someone else (like a parent or adult child) occupies the new home and you co-sign or co-borrow, the home could be treated as their primary residence. - Military deployment:

As a service member, you can retain your original home as primary even when deployed, and finance a new primary home near your duty station.

What about US Senate and Congressmen? They’re required to maintain a residence in their home state but spend months in Washington D.C..

U.S. Senators and Representatives can apply for financing for a primary residence in Washington, D.C., while maintaining their legal residence in their home state, but there are nuances in how lenders classify the property—and that distinction matters for loan approval and rates.

Legal Residence vs. Primary Residence (Occupancy)

- A legal or voting residence must remain in their home state to meet constitutional requirements.

- A primary residence for lending purposes refers to where the borrower intends to live most of the year, which can be D.C. if they spend the majority of their time there due to congressional duties.

Lenders define a primary residence as: "The property the borrower occupies most of the year, typically within 60 days of closing, and not a second home or rental."

So, if a member of Congress lives in D.C. most of the time while in session, they can legitimately finance a D.C. home as a primary residence, even if they keep a legal/voting address in their home state.

But what if they already have a mortgage on the property in their home state?

If they already have a mortgage designated as a primary residence in their home state, they cannot simply take out another “primary residence” mortgage for a D.C. home.

Let me give you a specific example that comes up all the time to help ease your mind for a situation that may arise in your future. You own your primary residence and have an owner-occupant mortgage. You decide to buy a new home and keep the current home as a rental. You are 100% allowed to apply for a new owner-occupant loan on the new property and are not required to refinance the existing property.

The example above is different than what’s alleged for the US Senator. He didn’t give up occupancy of the home in his state. In fact, he still gets a tax break as an owner-occupant. Under the rules, one cannot have two owner-occupant primary residences.

I’m not sure how the justice dept. will view the referral made this week. It would be interesting to do the research to find out how many politicians from both sides of the isle have ignored or played loosely with mortgage rules to get favorable rates and terms. Yes, the move is political gamesmanship, but on the other hand, everyone – including our representatives should have to play by the same rules as all of us must follow.

And now the week’s economic news…….

Mixed Data

It was a relatively quiet week for mortgage markets. The major inflation data was a little weaker than expected, but consumer spending was a good deal stronger than forecasted. The net result was that mortgage rates ended the week nearly unchanged.

The Consumer Price Index (CPI) is one of the most closely watched inflation indicators released each month. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors look at core CPI, which excludes food and energy. In June, Core CPI rose just 0.2% from May, below the consensus for an increase of 0.3%. It was 2.9% higher than a year ago, up from 2.8% last month, which was the lowest annual rate since March 2021.

The Consumer Price Index (CPI) is one of the most closely watched inflation indicators released each month. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors look at core CPI, which excludes food and energy. In June, Core CPI rose just 0.2% from May, below the consensus for an increase of 0.3%. It was 2.9% higher than a year ago, up from 2.8% last month, which was the lowest annual rate since March 2021.

Although this annual rate has dropped sharply from a peak of 6.6% in September 2022, and from 3.9% in January of last year, it is still far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. Shelter (housing) costs continue to be a primary reason why progress on bringing down inflation remains challenging. By contrast, used vehicles, new vehicles, and airfares posted notable price declines in June. Investors also focused on price increases for items affected by tariffs such as home furnishings and apparel, which may continue in the future.

Another significant inflation indicator released this week, which measures costs for producers, also came in below the expected levels. The June core Producer Price Index (PPI) was flat from May, well below the consensus forecast for an increase of 0.2%. It was 2.6% higher than a year ago, down from an annual rate of 3.0% last month and the lowest since April 2024.

Consumer spending accounts for over two-thirds of U.S. economic activity, so investors pay close attention to the monthly Retail Sales report as a key measure of the health of the economy. Retail sales in June rose 0.6% from May, far more than the consensus forecast for an increase of just 0.2%, and they were a solid 4% higher than a year ago. Strength was seen in motor vehicles, home improvement, and apparel. In addition, spending at restaurants and bars increased significantly in June, despite some concerns that consumers are scaling back. Eating out tends to be one of the first discretionary items cut when people are trying to save money.

Next Week

Looking ahead, investors will continue to watch for additional information about tariff policies and monitor comments from Fed officials. It will be a light week for economic reports. Existing Home Sales will be released on Wednesday and New Home Sales on Thursday. Durable Orders will come out on Friday. In addition, the next European Central Bank meeting will take place on Thursday.

Until next week….

*** Please note that Freddie Mac publishes their weekly rate report on Wednesday mornings from data received Monday and Tuesday.

The graph above is intended to shown rate trends, and not “today’s current rate”. ***

Reviews From Our Past Clients

With every client, we promise to provide you with a comprehensive analysis of your mortgage needs, the best service possible, and the best rates we can find. We make it our mission to have every transaction close with our clients happy with the service we provided. Browse through the hundreds of reviews we’ve received from our clients posted on both Google and Zillow.com, and read what they thought of their experience using Hawaii Mortgage Company.

Google Link:

Hawaii Mortgage Company Review on Google.com

Zillow.com Link:

Hawaii Mortgage Company Reviews on Zillow.com

Our Rate Quote System is Available to You

Our automated rate quoting system is live. Now you can check rates and try different scenarios 24-hours a day. Remember, it’s just a computer. For non-standard rate quotes, such as construction, vacant land, and other specialty programs, you’ll still need to give a call.

Here’s the link: https://www.hawaiimortgage.net/todays-rates/

Do you think all lenders are the same?

There is a difference when you use Hawaii Mortgage Company for your financing. Here’s a short video telling you why:

Broker vs. Banker?

Click the link below to get a quick lesson on why working with a Mortgage Broker will benefit you on your next transaction.