Compliments of

President | NMLS #: 297154

Hawaii Mortgage Company, Inc.

Company NMLS #: 232582

Alan Van Zee is one of the top producing Mortgage Originators in the state, originating over $2,000,000,000 to date. He has written and published this weekly newsletter for the past 17 years. It is the most widely read mortgage, real estate, and finance publication in Hawaii.

Hawaii Mortgage Company, now in our 25th year of providing mortgages to the people of Hawaii, is proud to have a complaint-free history. We make sure our clients are happy!

Mortgage Market News and Insight

For the Weekend of July 26th, 2025

Hawaii’s Most Read Mortgage, Real Estate, and Finance Publication for 17 Years

Volume 17 – Issue 44

Oh, Maui… What Are You About to Do?

Thursday evening the Maui County Council’s Planning Committee voted 6-3 to rescind a nearly 40 year old agreement which allows roughly 7,000 condo units to be used for short-term vacation rentals. The measure still needs to pass a couple more votes before going to the mayor for his signature. Since the full council sits on the Planning Committee and has already voted 6-3, the bill is expected to pass. This bill was introduced by the mayor, and he testified his support for it. His signature would be a formality.

Owners of the affected units have already started getting their legal team together. They realize that the county has the power to change zoning, which is the same as rescinding the agreement they have in place. Their contention is that by rezoning, the county is causing them an economic loss, and the government must compensate when they caused the loss.

Without the bill even passing, the condo owners seem to have the data on their side. The threat of these condo units losing their ability to be rented short-term has already impacted their value and has slowed sales significantly.

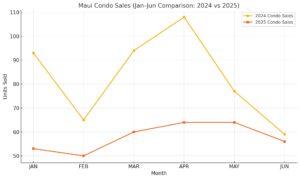

In the past 6 months alone, condo sales have dropped 30% from 496 units to 347. And the drop cannot be blamed on high interest rates. Rates today are the same as they were 12 months ago. Scroll down to the Freddie Mac historical rate chart I include week in my newsletter. What has changed in the collective sentiment about the future of Maui. In a word – uncertain.

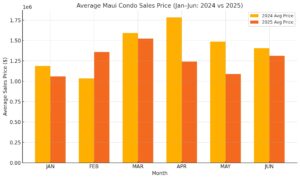

Using the same period of time as the first graph above, comparing the first 6 months of 2024 versus 2025, every month the average condo price is lower expect for February of this year. April 2025 and May 2025 show the largest drops. I am using Average Sale Price and not Median Sales Price because I believe for this data, average is more accurate than median.

The testimony in favor of the measure painted grand ideas everyone can rally behind. Who would not be in favor of residents being able to own their own home where they were born and raised? But the devil is in the details, and what was omitted really changes everything.

- Removing 7,000 vacation rentals will severely impact the island’s economy.

- If passed, the prohibition on STVR usage will be in 3 years for some units, and up to 5 years for others. In that amount of time the county could build new housing projects, instead of focusing on these 7,000 units owned by others.

- In testimony, it is estimated that the county may only “need” less than 1,000 of the units, but if the bill were to go after a portion of the units versus all 7,000, the county has been advised they will be an easy target for a lawsuit.

- The reason only 1,000 units may be needed is that 1,000 is the estimated number of people that could afford these high-cost units.

- The original intent of this bill was to help the Lahaina fire victims. Yet, of the 7,000 units targeted, only 2,000 are in west Maui. The bulk of the units are situated in the Kihei area.

I find it crazy that the leaders of Maui are enthusiastically leaping of this cliff for an unknown economic future, in exchange for providing a limited number of residents the opportunity to live in condos with high maintenance fees.

Too much of the testimony focused on “us versus them”. No one said it, but the sentiment of “haole go home” was fresh in the air. For the past 30 years when the “rich haoles” were buying all these condos and helping pump millions of dollars in Maui’s economy what did Maui’s political leaders do to expand the island’s economy and promote development of affordable housing?

I don’t blame those who testified in favor of canceling the short-term rentals. Everyone should have a place to call home, without having to go broke in exchange. I do put blame squarely on Maui’s past and present political leaders for doing nothing for decades to avoid the situation at hand. The Lahaina fire didn’t cause the housing crisis on Maui; it only exacerbated it.

If Maui had real political leadership their response to those in favor of this measure would be simple. “We cannot lose the economic impact of these units to our economy. Instead of forcing these people out, we will do the following:”

- Fast track permitting to allow developers to build additional units for sale ASAP.

- We will work with the state to set up special finance bonds to help those in need obtain a mortgage at special rates.

- We can set up a program to help with down payment assistance.

- We will do all we can to get homes in Lahaina rebuilt for the residents.

- We will work with business leaders to rebuild the commercial businesses lost in the fire.

To me, that’s a better path forward. For those of us on the other islands, our housing situation is dire too. Maybe it is time we pressed our political leaders to address our state’s serious housing issue now. If not, what is happening on Maui may be coming to another island soon.

And now the week’s economic news…….

Home Sales Fall

With little major economic data, it was another quiet week for mortgage markets, and rates ended the week nearly unchanged.

In June, sales of existing homes fell 3% from May to the lowest level in nine months. The median existing-home price of $435,300 was up a slim 2% from last year at this time, but at a record for the month of June. Inventories remain stuck at low levels, standing at just a 4.7-month supply nationally. However, inventories were 16% higher than a year ago.

In June, sales of existing homes fell 3% from May to the lowest level in nine months. The median existing-home price of $435,300 was up a slim 2% from last year at this time, but at a record for the month of June. Inventories remain stuck at low levels, standing at just a 4.7-month supply nationally. However, inventories were 16% higher than a year ago.

Sales of new homes displayed better performance in June, rising slightly from May, but still were 7% lower than a year ago. The median new-home price of $401,800 was down 3% from last year at this time. In contrast to existing homes, the supply of new homes remains near the highest level since 2009. Existing home sales measure actual closing during the month, while new home sales are based on contracts signed, making them a leading indicator of future housing market activity.

The Department of Labor releases the total number of new claims for unemployment insurance each week. The latest reading was just 217,000, below the consensus forecast and the lowest level since April. Bigger picture, this was far below the inflated figures seen during the early months of the pandemic, and in line with the levels which were typical during 2019. Weekly jobless claims are important because they are one of the timeliest indicators of labor market trends. While other recent economic reports suggest that companies may be scaling back on hiring new employees, this report indicates that they remain reluctant to lay off workers.

On Thursday, the European Central Bank (ECB) held benchmark interest rates unchanged at 2.0%, down from a record high of 4.0% in the middle of 2023. This move was widely anticipated, and the reaction was minor. In its meeting statement, the ECB said that the environment remains "exceptionally uncertain" due to trade disputes and that the risks to economic growth are "tilted to the downside."

Next Week

Looking ahead, investors will continue to watch for additional information about tariff policies. The next Fed meeting will take place on Wednesday. No change in the federal funds rate is expected, and investors will be looking for hints about monetary policy later in the year. For economic reports, second quarter GDP, the broadest measure of economic activity, will come out on Wednesday. Personal Income and the PCE price index, the inflation indicator favored by the Fed, will be released on Thursday. The ISM national manufacturing index will come out on Friday.

Until next week….

*** Please note that Freddie Mac publishes their weekly rate report on Wednesday mornings from data received Monday and Tuesday.

The graph above is intended to shown rate trends, and not “today’s current rate”. ***

Reviews From Our Past Clients

With every client, we promise to provide you with a comprehensive analysis of your mortgage needs, the best service possible, and the best rates we can find. We make it our mission to have every transaction close with our clients happy with the service we provided. Browse through the hundreds of reviews we’ve received from our clients posted on both Google and Zillow.com, and read what they thought of their experience using Hawaii Mortgage Company.

Google Link:

Hawaii Mortgage Company Review on Google.com

Zillow.com Link:

Hawaii Mortgage Company Reviews on Zillow.com

Our Rate Quote System is Available to You

Our automated rate quoting system is live. Now you can check rates and try different scenarios 24-hours a day. Remember, it’s just a computer. For non-standard rate quotes, such as construction, vacant land, and other specialty programs, you’ll still need to give a call.

Here’s the link: https://www.hawaiimortgage.net/todays-rates/

Do you think all lenders are the same?

There is a difference when you use Hawaii Mortgage Company for your financing. Here’s a short video telling you why:

Broker vs. Banker?

Click the link below to get a quick lesson on why working with a Mortgage Broker will benefit you on your next transaction.