Compliments of

President | NMLS #: 297154

Hawaii Mortgage Company, Inc.

Company NMLS #: 232582

Alan Van Zee is one of the top producing Mortgage Originators in the state, originating over $2,000,000,000 to date. He has written and published this weekly newsletter for the past 17 years. It is the most widely read mortgage, real estate, and finance publication in Hawaii.

Hawaii Mortgage Company, now in our 25th year of providing mortgages to the people of Hawaii, is proud to have a complaint-free history. We make sure our clients are happy!

Mortgage Market News and Insight

For the Weekend of August 2nd, 2025

Hawaii’s Most Read Mortgage, Real Estate, and Finance Publication for 17 Years

Volume 17 – Issue 45

Living in the Danger Zone

Well, that was quite a shock we all experienced this past week. The threat of a tsunami crashing onto our shores caused panic and gridlock on every island. Thankfully, the results were not catastrophic. As I wrote about almost 2 years ago, living in Hawaii makes us susceptible to many dangers that most were unaware of – until something bad happens. Let’s explore those dangers and what choices you can make to mitigate them.

When you think about Hawaii in these terms: Living on an eroding island, within a volcanic chain of islands, sitting in the middle of the largest ocean on the planet, and being the most remote inhabited spot on the planet, it paints a picture much different than balmy sunsets on the beach. Our location, topography, geology, and remoteness create an elevated risk for bad things to happen to us.

How can you mitigate the perils of living in paradise? Know the dangers, decide the level of risk you are comfortable with, and be prepared.

The Dangers of Living in Paradise:

Tsunamis

This week’s tsunami woke up a lot of people to the fact that the inundation maps we grew up with that were listed in the first few pages of the phone book have been updated. Many inland areas thought to be safe are now in a tsunami inundation zone.

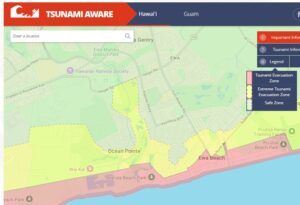

The state now offers maps online you can access to see if your individual home lies in an inundation zone. One of the criticisms I had with the coverage that night and the updates from the government officials was if they estimated the potential tsunami to be an “extreme” tsunami or not. As you can see from the legend above, the red areas are the “normal” tsunami zone, while the yellow is reserved for “extreme” events. In talking with neighbors and friends, those in the yellow areas evacuated as well. Maybe with some clarification for future events it could litigate the gridlock and panic.

With this knowledge now so easily accessible you should check out these maps when considering where to purchase a home. And if you already live in either the red or yellow zones, create a plan of action on what to do when we get the next alert.

Brush Fires

We also saw this workweek end with red flag warnings for potential brush fires due to high winds. It hasn’t even been two years since the Lahaina fire and Oahu has seen its share of brush fires on the leeward coast. There are a lot of former agricultural lands that have been converted to housing. Many of those properties still abut acres of dry brush.

When considering where to live, you should take into account what your neighborhood is next to. Maybe that adjacent area is slated for development in a few years, but right now is that area a fire hazard? Where is the closest fire hydrant to your home? How far is the closest fire station? You need to find the answers to these questions when not only considering a home purchase, but also for the current place you live.

Hurricanes

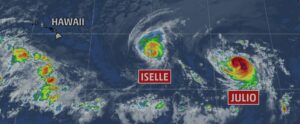

It certainly was a weird week for weather. While we were all waiting for the tsunami, there was a hurricane a few hundred miles south of our island chain. In recent years Hawaii Island has taken the brunt of the impact from hurricanes. For those of us on Oahu, we’ve never recorded a direct hit from a hurricane. However, since 1950, we’ve had 9 hurricanes that have come within 200 miles of our island.

Hurricane Hiki (1950)

- Closest Approach: ~100 miles north of Hawaiʻi Island (indirectly affected Oʻahu)

- Impact: Tropical-storm-force winds, light damage on Oahu.

Hurricane Nina (1957)

- Closest Approach: ~120 miles south of Oahu

- Impact: 82 mph gusts at Honolulu Airport; 1 fatality (electrocution), roof and power line damage.

Hurricane Dot (1959)

- Closest Approach: ~90 miles south of Oahu (landfall on Kauai)

- Impact: Surf damage, coastal flooding, heavy rains on Oʻahu.

Hurricane Iwa (1982)

- Closest Approach: ~25 miles from Kauai, affecting Oahu

- Impact: Gusts over 100 mph, storm surge, structural damage, power outages.

Hurricane Estelle (1986)

- Closest Approach: ~100–200 miles south

- Impact: High surf, two drownings, flooding on Oʻahu.

Hurricane Uleki (1988)

- Closest Approach: Stalled southwest of Hawaiʻi (~200 miles from Oʻahu)

- Impact: High surf caused drownings; hazardous coastal conditions.

Hurricane Iniki (1992)

- Closest Approach: Made landfall on Kauai (~130 miles from Oʻahu)

- Impact: Tropical-storm-force winds, storm surge, beach erosion, two fatalities on Oʻahu.

Hurricane Kenneth (2005)

- Closest Approach: ~200 miles south of Oahu

- Impact: Heavy rain (~12 inches), flooding in low-lying areas.

Hurricane Douglas (2020)

- Closest Approach: ~30 miles north of Oahu (closest on record)

- Impact: Tropical-storm-force winds, heavy rain, downed trees, minor flooding.

What can you do proactively to minimize the effects of a hurricane, if one were to land? Does your home have hurricane clips tying the roof support to the walls? Is your home single walled construction? There are still a lot on the islands. They won’t fare well against high winds. Investigate your potential new home’s construction. Also, valleys tend to accelerate winds coming over the mountains. Maybe consider not buying that home deep in the back of one of our lush valleys? Location is an important factor when dealing with high winds.

Floods

While we’ve been lucky with hurricanes (the exception being Kauai with Iwa in ’82 and Iniki in ‘92) the damage we’ve most encountered with tropical events (hurricanes and tropical storms) has been flooding.

Floods rank #1 for being the costliest disasters in our state. Even with the Lahaina fire estimated at almost $6-billion, if you adjust for inflation, flood damage over the years far exceeds that figure.

FEMA also has flood maps readily available online for review. Those maps were also updated over the past few years. Your home may now reside in a newly designated flood zone. You’ll know because either your lender or your insurance company will now require you to obtain flood insurance. Still, you should check for yourself.

Before you buy that new home, do the research on the flood zones. All valleys on every island were carved out from wind and rain resulting in streams that moved sediment to the ocean. Next time you’re driving up the Nuuanu Pali or go into Manoa valley, or Moanalua or Halawa, stop and look how big those valleys are. Water is why those valleys exist today.

Rockslides

Just a quick note on rocks dislodging from the side of a hill and possibly crushing your home. If you live or are considering purchasing a home along the side of a hill with exposed rock, there’s the potential for rockslides. Over time what’s supporting the exposed rocks in place will eventually erode. That’s why what’s safe today may not be after the next big rain. This is just one more factor to consider when deciding on where to live.

Remoteness

Our last danger is remoteness. If our islands were to suffer a significant event, the possibility of harbor and airport damage is not a far-fetched possibility. That would result in shortages we haven’t seen in the islands since the dock workers’ strikes in 1949 and 1971. As a kid I remember going to the store in 1971 and seeing isle after isle of empty shelves.

A day before a weather event is not the time to hit Costco for rice, toilet paper, spam, and bottled water. You should keep your home well stocked or invest in multi-day meal kits (also sold at Costco). Right now, you may think that you’ll be fine on day 17 eating another portion of spam and rice. While the survival meals may not be gourmet, many are designed to keep your calorie intake stable and not spike you with sodium like our island’s favorite canned meat. You should also look into emergency water containers. These heavy-duty versions of garbage bags can be filled from a tap or hose and can hold nearly 100 gallons each. You keep them empty and nicely folded away until just before you’d possibly need them. Amazon has them for under $50 each.

To recap a lot of information: We live with danger all around us. We can minimize and mitigate some of that danger by researching the safest places on each island to live, while making sure we are proactive and prepared with adequate supplies in case of disaster. Despite all that, as Guy Hagi says, “Still the best weather on the planet!”

Trump Fires BLS Official

The monthly jobs report from the Bureau of Labor Statistics is currently the most important economic report issued by our government. On Wednesday the Fed Chair Jerome Powell cited continued strong employment from the BLS reports as his rationale for keeping interest rates high and restricting the economy.

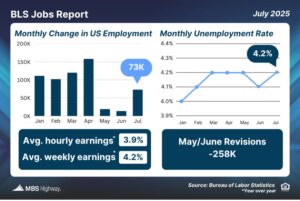

In May all economic signs were pointing to a disappointing jobs number. The BLS surprised everyone, reporting 144,000 new jobs were created. Today that number was revised sharply lower to only 19,000 jobs created. The same held true for June. Job creation numbers for June were forecast to be weak as well. The BLS once again surprised Wall Street by reporting 147,000 job gains. Today that number was revised down to just 14,000 job creations. The downward corrections of 258,000 jobs directly impact YOU.

A strong labor market can lead to higher inflation. The inaccurate reporting by the BLS influenced the FED to not cut interest rates. Also, the flawed reports impacted the decisions of bond traders who have been holding off buying bonds which would reduce mortgage interest rates.

President Trump had enough. On Friday, the President ordered the firing of Dr. Erika McEntarfar, the Commissioner of Labor Statistics at the BLS. This is not a political issue. The BLS has been terribly wrong in their reporting for a couple of years now. I’m even written here in the past on how what’s being reported sure doesn’t sync with the real world. Hopefully what we’ll see in the future is accurate numbers to reflect the true state of the economy.

Interest rates made a nice move lower on Friday after the release of the jobs report and corrections. Let’s see next week if the trend will continue.

And now the week’s economic news…….

BLS Finally Corrects Rosy Prior-Months Erroneous Jobs Data

Heading into the highly anticipated Employment report on Friday, mortgage rates were nearly unchanged from the prior week. The data on job gains was much weaker than expected and rates ended the week lower.

The key Employment report revealed that the economy added an anemic 73,000 jobs in June, below the consensus forecast of 100,000. The big shocking news, however, was that downward revisions to the past two months of data reduced the results by a massive 258,000 jobs. The only sectors to show job gains were primarily in the health care, retail, and social assistance sectors.

The key Employment report revealed that the economy added an anemic 73,000 jobs in June, below the consensus forecast of 100,000. The big shocking news, however, was that downward revisions to the past two months of data reduced the results by a massive 258,000 jobs. The only sectors to show job gains were primarily in the health care, retail, and social assistance sectors.

The other major components of the Employment report contained no significant surprises. As expected, the unemployment rate increased from 4.1% to 4.2%, which is still reasonably low by historical standards. Average hourly earnings, an indicator of wage growth, were 3.9% higher than a year ago, up from an annual rate of 3.7% last month, which was the lowest level since the middle of 2021.

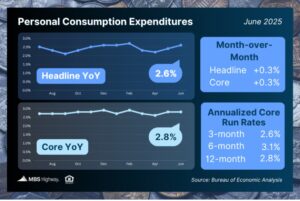

Fed officials keep a close eye on inflation, and the PCE price index is their favored indicator. In June, Core PCE was 2.8% higher than a year ago, the same annual rate of increase as last month and matching the consensus forecast. Progress toward the 2.0% target of the Fed has not been easy, and this desired level has not been achieved since February 2021. The big question remains how large an impact higher tariffs will have on future inflation levels.

Fed officials keep a close eye on inflation, and the PCE price index is their favored indicator. In June, Core PCE was 2.8% higher than a year ago, the same annual rate of increase as last month and matching the consensus forecast. Progress toward the 2.0% target of the Fed has not been easy, and this desired level has not been achieved since February 2021. The big question remains how large an impact higher tariffs will have on future inflation levels.

The Fed meeting on Wednesday caused little reaction. As expected, the Fed made no change to the federal funds rate, leaving it at a range between 4.25% to 4.50% where it has been since December. The meeting statement was similar to the prior one, emphasizing the high degree of uncertainty about the economic outlook due to changes in government policies. After factoring in the weak labor market data, most investors now anticipate that there will be a 25 basis point rate cut at the next meeting in September and another one at the meeting in December.

Next Week

Looking ahead, investors will continue to look for additional information about tariffs and monitor comments from Fed officials for hints about monetary policy later in the year. It will be a light week for economic reports. The ISM national services sector index and the Trade Deficit will come out on Tuesday.

Until next week….

*** Please note that Freddie Mac publishes their weekly rate report on Wednesday mornings from data received Monday and Tuesday.

The graph above is intended to shown rate trends, and not “today’s current rate”. ***

Reviews From Our Past Clients

With every client, we promise to provide you with a comprehensive analysis of your mortgage needs, the best service possible, and the best rates we can find. We make it our mission to have every transaction close with our clients happy with the service we provided. Browse through the hundreds of reviews we’ve received from our clients posted on both Google and Zillow.com, and read what they thought of their experience using Hawaii Mortgage Company.

Google Link:

Hawaii Mortgage Company Review on Google.com

Zillow.com Link:

Hawaii Mortgage Company Reviews on Zillow.com

Our Rate Quote System is Available to You

Our automated rate quoting system is live. Now you can check rates and try different scenarios 24-hours a day. Remember, it’s just a computer. For non-standard rate quotes, such as construction, vacant land, and other specialty programs, you’ll still need to give a call.

Here’s the link: https://www.hawaiimortgage.net/todays-rates/

Do you think all lenders are the same?

There is a difference when you use Hawaii Mortgage Company for your financing. Here’s a short video telling you why:

Broker vs. Banker?

Click the link below to get a quick lesson on why working with a Mortgage Broker will benefit you on your next transaction.