Compliments of

President | NMLS #: 297154

Hawaii Mortgage Company, Inc.

Company NMLS #: 232582

Alan Van Zee is one of the top producing Mortgage Originators in the state, originating over $2,000,000,000 to date. He has written and published this weekly newsletter for the past 18 years. It is the most widely read mortgage, real estate, and finance publication in Hawaii.

Hawaii Mortgage Company, now in our 26th year of providing mortgages to the people of Hawaii, is proud to have a complaint-free history. We make sure our clients are happy!

News and Insight

For the Weekend of November 8th, 2025

Hawaii’s Most Read Mortgage, Real Estate, and Finance Publication for 18 Years

Volume 18 – Issue 9

Are Your Condo Reserves Adequately Funded?

I recently had a client looking to move here from the mainland and purchase a condo for his retirement. The condo he chose was spacious and beautiful. His concern was the high monthly maintenance (HOA) fees. As a former developer of properties on the mainland he dove into the condo disclosure documents for a deeper look. He didn’t like what he found and decided to pass on that project.

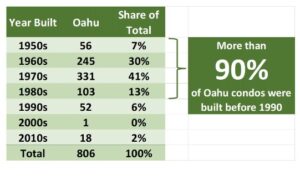

If you are planning on buying a condo or currently own a condo, you need to pay close attention to the financial decisions the condo association board is making on behalf of the project. Many projects throughout the state are seeing enormous jumps in monthly HOA fees. These increases are all attributable to the project’s age.

It’s something we don’t think about, but much of the housing in our state is old. While most of the condos in Hawaii were built in the 60’s-80’s, so were most of the single-family homes. That’s why insurance rates in our state have skyrocketed in the past couple of years. Older structures are prone to failures which insurance companies are left holding the bag for and paying out claims. For condos, the amount of claims paid due to flooding from failed pipes is some of the highest in the nation. For the single-family home market, every buyer I’ve helped obtain financing for has been grilled by the insurance companies wanting to know how old the current roof is. Roof claims made to insurance companies also jumped exponentially in the past few years.

But condos are different than owning your own home. For a condo, you have a board of directors made up of owners willing to do the dirty work for the association - without compensation. There’s no formal training required, and no requirement to have any background in financial matters. Board members usually volunteer because they have a specific gripe or issue with the project they want addressed. I saw this firsthand as a former condo board president myself.

For some associations, the annual budget for the association could be several million dollars. How do you feel about Karen the Complainer setting fiscal policy that will affect your monthly HOA fees? More important, those decisions made by the volunteer board will impact on how your project is managed and maintained. The board isn’t flying blind. Every project I know of in Hawaii utilizes a professional property management company to help guide the board.

What killed the deal with my client the retiree was the insufficient of funding for the project’s reserve fund. A reserve account is money being set aside for future repairs and maintenance. The state does have laws on how a project is supposed to fund that account, but there are loopholes and ways to underfund what is needed.

The reserve analysis is a study done supposedly by professionals to establish the actual life of a component of the project, such as a roof or asphalt driveway. The analysis will also plug in estimated for inflation to account for higher costs years down the road. A smart condo board will recognize that a well-maintained project will protect and enhance the value of each unit in the project. Too often than not, projects try and cut corners to keep HOA fees low. This will result in inadequate or deferred maintenance, or could lead to a special assessment.

While the reserve analysis is a way to project future costs, when a board decides to push out future repairs, they are giving themselves an economic gain to be paid for by future owners in the project. For example. If the project needs to be painted every 10 years at a cost of $100,000 that means all the owners are collectively responsible for $10,000 of that future bill each year. But what if the reserve analysis were to change the painting schedule to 12 or 15 years? That would result in current owners paying less into the fund. Repeat that with multiple items on reserve analysis, and it can change significantly what current owners pay into the fund. That’s what my client found when reviewing the condo disclosure documents.

If your plan is to buy a condo, I cannot stress how important it is for you to read through the entire set of disclosures documents the seller provides. If there is something you don’t understand, that’s why you have a real estate agent representing you in the transaction. Is the project properly funded? When were the pipes replaced? Just looking at the project, does it look like there’s deferred maintenance? These simple questions could predict how much your HOA fees will increase in the future.

If you already own a condo, when was the last time you went to a board meeting? How’s the repair and maintenance of your project being done? How do you think the project will look in the next few years when you may wish to sell and move?

If you are looking to buy a home versus a condo, we never ask some of the real important questions regarding regular maintenance and those associated costs. When was the roof last redone? What about paint? Windows? Are the lights converted to LED? How much are the utility bills?

The message today is to be aware of costs you may not have considered. With HOA fees consistently rising, how your project is maintained is vitally important. And just because you are buying a house, don’t forget to ask about upkeep either.

I’m just a humble mortgage and finance guy and don’t dabble into the mystic world of social media. I have been instructed by those that know of these things that I need to ask you all a favor to help build my Facebook audience. If you like my newsletter, I kindly ask that you click the link below and follow me. By doing so, it helps the search engines of the world find me when people are looking for a mortgage.

https://www.facebook.com/profile.php?id=100063640266690

And now the week’s economic news…….

Mixed Data

With the lack of major economic data due to the government shutdown, investors continued to react to the reports from private companies this week. The services sector of the economy was stronger than expected, but the labor market displayed signs of softening. These results were roughly offsetting, and mortgage rates ended the week with little change.

Two significant economic reports released this week by the Institute of Supply Management revealed mixed results. The ISM national services sector index jumped to 52.4, far above the consensus forecast, while the national manufacturing index unexpectedly fell to just 48.7. Readings above 50 indicate an expansion in the sectors and below 50 a contraction. Service firms continue to outperform, but higher tariffs on foreign goods may provide a boost to domestic manufacturing companies over time.

The latest survey on consumer sentiment published by the University of Michigan revealed that consumers remain quite concerned about the impact of higher tariffs and the government shutdown. The index dropped to just 50.3, far below the consensus forecast of 53.0 and the lowest level since June 2022 (which was the record low of 50.0). The component of the report on inflation expectations showed that the five-year average outlook unexpectedly fell, which was good news for mortgage markets.

The latest survey on consumer sentiment published by the University of Michigan revealed that consumers remain quite concerned about the impact of higher tariffs and the government shutdown. The index dropped to just 50.3, far below the consensus forecast of 53.0 and the lowest level since June 2022 (which was the record low of 50.0). The component of the report on inflation expectations showed that the five-year average outlook unexpectedly fell, which was good news for mortgage markets.

With the lack of government economic data during the shutdown, investors continue to look for alternative information from private companies. Two such reports released this week revealed concerning news about the labor market. First, layoffs soared in October, according to a large outplacement firm. Job cuts increased a massive 183% from September, the highest level for the month of October since 2003. This has been the worst year for layoffs since 2009. In addition, jobs site Indeed reported that job postings fell to the lowest level since February 2021 during the pandemic. Fewer postings suggest less competition for workers, meaning that companies are less likely to offer higher pay to attract additional employees. This reduces future inflationary pressures from wages, which is positive for mortgage markets.

Next Week

Looking ahead, investors will continue to watch for additional information about tariffs and monitor comments from Fed officials for hints about monetary policy later in the year. With the government shutdown, it will likely be another light week for major economic data. If it is released on schedule, the focus will be on CPI on Thursday. The Consumer Price Index (CPI) is a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services. Mortgage markets will be closed on Tuesday for Veterans Day.

Until next week….

*** Please note that Freddie Mac publishes their weekly rate report on Wednesday mornings from data received Monday and Tuesday.

The graph above is intended to shown rate trends, and not “today’s current rate”. ***

Reviews From Our Past Clients

With every client, we promise to provide you with a comprehensive analysis of your mortgage needs, the best service possible, and the best rates we can find. We make it our mission to have every transaction close with our clients happy with the service we provided. Browse through the hundreds of reviews we’ve received from our clients posted on both Google and Zillow.com, and read what they thought of their experience using Hawaii Mortgage Company.

Google Link:

Hawaii Mortgage Company Review on Google.com

Zillow.com Link:

Hawaii Mortgage Company Reviews on Zillow.com

Our Rate Quote System is Available to You

Our automated rate quoting system is live. Now you can check rates and try different scenarios 24-hours a day. Remember, it’s just a computer. For non-standard rate quotes, such as construction, vacant land, and other specialty programs, you’ll still need to give a call.

Here’s the link: https://www.hawaiimortgage.net/todays-rates/

Do you think all lenders are the same?

There is a difference when you use Hawaii Mortgage Company for your financing. Here’s a short video telling you why:

Broker vs. Banker?

Click the link below to get a quick lesson on why working with a Mortgage Broker will benefit you on your next transaction.