Compliments of

President | NMLS #: 297154

Hawaii Mortgage Company, Inc.

Company NMLS #: 232582

Alan Van Zee is one of the top producing Mortgage Originators in the state, originating over $2,000,000,000 to date. He has written and published this weekly newsletter for the past 18 years. It is the most widely read mortgage, real estate, and finance publication in Hawaii.

Hawaii Mortgage Company, now in our 26th year of providing mortgages to the people of Hawaii, is proud to have a complaint-free history. We make sure our clients are happy!

News and Insight

For the Weekend of December 20th, 2025

Hawaii’s Most Read Mortgage, Real Estate, and Finance Publication for 18 Years

Volume 18 – Issue 14

Maui’s Bill 9 Becomes Law

Society runs smooth when the “haves” give enough to the “have nots” to keep them complacent. Give the poor enough to survive on, and for the most part they will leave the rich alone. We have seen this story play throughout time. As the poorest become desperate they begin to seek solutions normally not ever considered. In New York city, the people elected an openly socialist mayor. In Maui, the people pushed their elected leaders to openly take from those more fortunate to give to them.

When the wildfire that swept through Lahaina in 2023, it displaced the largest population of those earning the least on Maui. Many homes were rentals – shared by more than one to a room. Many homes were very old and passed down for generations. Lahaina also had a large population of homeless living in the shadows – until fire burned away their cover. Maui was already suffering from a shortage of housing that made the valley isle one of the costliest places to live in the state. Despite the fire only taking roughly 2% of the island’s homes, that reduction in inventory turned a bad situation into a crisis.

As with any crisis, government came to the rescue with suitcases full of cash (a metaphor), believing that what a dramatic imbalance in supply and demand for housing needed was seemingly unlimited cash being tossed around. As the Lahaina residents sought shelter in other areas of the island with cash in hand, it further exacerbated home costs. Rents skyrocketed. So did home prices. Those that took insurance settlements competed to buy a home from an already limited supply.

Then the sovereignty groups spoke up. This small vocal group, pushed to reimagine the future Lahaina to return to the Lahaina of 150 years ago. As they squatted and protested in front of the hotels in Kaanapali demanding housing, Maui’s Mayor Richard Bissen took note.

As the story goes – starting almost 50 years ago, developers built many projects on Maui, primarily in the Kihei area, that were zoned one way, but the units built were for a different purpose. These projects were built in areas zoned for apartments. The units built were small, primarily studios, that really didn’t accommodate long term habitation. That’s fancy talk for the units were built for tourists not residents. At an era when Maui wanted more tourism, the county loved the idea of having additional short-term rental units. That is when the official Minatoya List was adopted. The county recognized the need for more tourist accommodation and formally allowed these units to act as de facto hotels.

Mayor Bissen couldn’t ignore homeless Hawaiians on the beach in front of tourists paying upwards of $1,000 per night seeking a tropical paradise. That’s when in May of 2024 – just 7 months after the Lahaina fire, he introduced Bill 9. The purpose of Bill 9 was to do away with the Minatoya List unit’s exemption for use as short-term vacation rentals. As the bill proceeded through the governmental process, hundreds of hours of testimony was received. The testifiers fell into 2 camps. Those that benefit from the units – the owners and the many small businesses that make their living managing the units and servicing the tourists that utilize them, and the other group made up of angry Maui residents demanding adequate housing for residents.

The mayor, a lawyer by trade and a former judge, was well aware of the legal implications of Bill 9 and what it would cost the county in lawsuits brought by unit owners. Everyone also knows that most of these units are not designed for residential use, as many units don’t have full kitchens. And the units that are big enough to support a family living in them would be unaffordable to buy. Most current owners can’t convert their units to long-term rentals because of the mortgage and other monthly expenses they incur. Long-term rents are insufficient to cover those costs. They’d be forced to sell – and the mayor is well aware of that. Which is why owners have grounds to sue.

The final language in the bill that passed holds a provision that the Minatoya owners can apply to be rezoned into a classification that allows for short-term rentals. The only issue is that those classifications have not been created by the county yet. Your guess is as good as mine if this provision in the bill is a way for the county to preventively try to cover the asses from lawsuits or create a backdoor to get out of this conflict quietly.

It's been 26 months since the fire. The homeless are still homeless and rentals are still impossible to find and cost and arm and a leg if you find one. What has happened is the owners of the STVR condos have lost an estimated $1-Billion dollars in value to their property. This fight has not happened in a vacuum. Excerpts of testimony from the fight for Bill 9 from those wishing to see a severe reduction in tourism are all over the internet. Tourism industry officials quietly recognize an uneasiness from potential vacationers not wanting to have their tropical vacation at a place where they’re not wanted.

And as it goes most times in government, I don’t believe any side in the dispute is happy with the outcome.

And now the week’s economic news…….

Inflation Eases

A flood of major economic data delayed by the government shutdown was released this week. The biggest surprise was that CPI inflation was much lower than expected. The reaction to this data was small, however, and mortgage rates ended the week just slightly lower.

The Consumer Price Index (CPI) is one of the most closely watched inflation indicators released each month. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors look at core CPI, which excludes food and energy. In November, Core CPI was just 2.6% higher than a year ago, far below the consensus forecast of 3.0%, and down from an annual rate of 3.0% in the prior report.

The Consumer Price Index (CPI) is one of the most closely watched inflation indicators released each month. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors look at core CPI, which excludes food and energy. In November, Core CPI was just 2.6% higher than a year ago, far below the consensus forecast of 3.0%, and down from an annual rate of 3.0% in the prior report.

Although this annual rate has dropped sharply from a peak of 6.6% in September 2022, it is still well above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. Overall prices are up about 25% since January 2020, more than double the roughly 10% increase seen in the prior five-year period. Some economists have noted that the latest inflation reading may have been skewed downward by the data collection period which began later in the month than usual due to the government shutdown. Companies generally discount their goods more heavily later in November for the holiday shopping season, possibly lowering average prices more than would have been seen during the normal collection period.

Against a consensus forecast of 50,000, the economy added 64,000 jobs in November. Strength was seen in health care, construction, and social assistance. However, the unemployment rate unexpectedly increased from 4.4% to 4.6%, the highest level since September 2021. Lessening its impact, though, the Bureau of Labor Statistics warned that the household survey which is used to calculate the unemployment rate will be affected for several months by the disruption in data collection during the shutdown. Average hourly earnings, an indicator of wage growth, were 3.5% higher than a year ago, down from an annual rate of 3.8% last month.

Against a consensus forecast of 50,000, the economy added 64,000 jobs in November. Strength was seen in health care, construction, and social assistance. However, the unemployment rate unexpectedly increased from 4.4% to 4.6%, the highest level since September 2021. Lessening its impact, though, the Bureau of Labor Statistics warned that the household survey which is used to calculate the unemployment rate will be affected for several months by the disruption in data collection during the shutdown. Average hourly earnings, an indicator of wage growth, were 3.5% higher than a year ago, down from an annual rate of 3.8% last month.

In November, sales of existing homes rose slightly from October, close to expectations, to the highest level in nine months. The median price of $409,200 was up a slim 1% from last year at this time. Inventories remain at a 4.2-month supply. However, inventories were 8% higher than a year ago. First-time buyers represented 30% of sales, well below typical historical levels of around 40%.

In November, sales of existing homes rose slightly from October, close to expectations, to the highest level in nine months. The median price of $409,200 was up a slim 1% from last year at this time. Inventories remain at a 4.2-month supply. However, inventories were 8% higher than a year ago. First-time buyers represented 30% of sales, well below typical historical levels of around 40%.

Next Week

Looking ahead, investors will continue to monitor comments from Fed officials for hints about monetary policy next year. With the end of the shutdown, the schedule for the release of delayed government economic reports continues to be gradually updated. GDP, New Home Sales and Consumer Confidence are scheduled to be released on Tuesday. Mortgage markets will close early on Wednesday and will be closed on Thursday for Christmas.

Until next week….

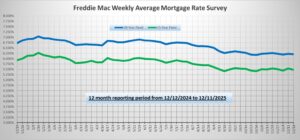

*** Please note that Freddie Mac publishes their weekly rate report on Wednesday mornings from data received Monday and Tuesday.

The graph above is intended to shown rate trends, and not “today’s current rate”. ***

Reviews From Our Past Clients

With every client, we promise to provide you with a comprehensive analysis of your mortgage needs, the best service possible, and the best rates we can find. We make it our mission to have every transaction close with our clients happy with the service we provided. Browse through the hundreds of reviews we’ve received from our clients posted on both Google and Zillow.com, and read what they thought of their experience using Hawaii Mortgage Company.

Google Link:

Hawaii Mortgage Company Review on Google.com

Zillow.com Link:

Hawaii Mortgage Company Reviews on Zillow.com

Our Rate Quote System is Available to You

Our automated rate quoting system is live. Now you can check rates and try different scenarios 24-hours a day. Remember, it’s just a computer. For non-standard rate quotes, such as construction, vacant land, and other specialty programs, you’ll still need to give a call.

Here’s the link: https://www.hawaiimortgage.net/todays-rates/

Do you think all lenders are the same?

There is a difference when you use Hawaii Mortgage Company for your financing. Here’s a short video telling you why:

Broker vs. Banker?

Click the link below to get a quick lesson on why working with a Mortgage Broker will benefit you on your next transaction.