Compliments of

President | NMLS #: 297154

Hawaii Mortgage Company, Inc.

Company NMLS #: 232582

Alan Van Zee is one of the top producing Mortgage Originators in the state, originating over $2,000,000,000 to date. He has written and published this weekly newsletter for the past 18 years. It is the most widely read mortgage, real estate, and finance publication in Hawaii.

Hawaii Mortgage Company, now in our 26th year of providing mortgages to the people of Hawaii, is proud to have a complaint-free history. We make sure our clients are happy!

News and Insight

For the Weekend of January 17th, 2026

Hawaii’s Most Read Mortgage, Real Estate, and Finance Publication for 18 Years

Volume 18 – Issue 17

Most Reporting Isn’t Good Reporting

I’m going to share with you three stories this weekend that run contrary to what you might have seen on the local TV news or seen in a headline while scrolling the interwebs. The most important thing I have learned after spending almost three decades in an industry that is widely reported on - is that more often than not, the reporting is inaccurate or sensationalized. That realization has led me to believe that if the journalists can’t get finance and real estate news correct, what are the chances they get the other news right?

Here’s the facts. Local TV stations pay poorly and are understaffed. Most of what you watch at night is a “reporter” regurgitating a government press release. There is no “reporting” anymore. Local radio stations are even worse. They have no dedicated reporters and simply read stories from other news sites.

If you get your news from social media, or the “news” articles that pop up while scrolling, I pray you don’t make life decisions on what you read.

Information has now become a tool people use to shape your beliefs. Some profit off of it. Some use the power of information for political gain. How do you know you’re being played? Always be skeptical. If the information being reported is important to you, do the research from multiple sources to try and uncover the truth. Just keep in mind that almost all sources of information have a bias one way or another.

With that in mind, I present three stories today that have stolen a lot of local and national headlines. I have thoroughly researched the material and present it to you - to correct the record.

Good News for Insurance Premiums – Finally!

There were two insurance related stories this week. One was that due to the state’s resurrection of the Hawaii Hurricane Relief Fund, many condo projects are seeing large reductions in their condo insurance premiums. That story is partly true. Many condo projects, including a project I have an investment unit in, have seen nice reductions in premiums for their renewals going into 2026.

The state’s program to help bring rates down was too late to the party. The HHRF did write policies for 50 condo projects that were not able to find insurance, but the HHRF is not why rates for condo projects in Hawaii are starting to drop.

For the world of insurance, 2025 was a year of smaller losses than the previous 5 years. The biggest factor in lower premiums is the cost your insurance company pays for “reinsurance”. Reinsurance is the policy your insurance company buys to cover their losses. It is projected that in 2026 that additional reinsurers will come into the market forcing competition and driving prices down.

That’s a win!

There was an additional story this week about homeowners who were dropped from their current insurer and seeing huge increases in their policy premiums. DTRIC is closing and DB stopped writing homeowners’ insurance in Hawaii. For those with policies from those companies, the pain will be short-lived. My advice to you is keep shopping, as you’ll find more competitive rates out there.

Click Bait & Fake News of Foreclosure Doom

This has been everywhere this week. Here are a couple of industry headlines many real estate agents saw this week:

Wait, is the housing market crashing? If so, would you want to buy a home today knowing the market is about to get flooded with foreclosed properties with banks competing to find a new owner? Of course not. If the information was true, you would want to wait. But the good news is that these headlines are made to generate clicks to their stories by scaring you.

What to see the real data?

We are nowhere near anything of what we saw in 2008-2012. 2021 & 2022 had a moratorium on foreclosures due to COVID.

Don’t get scammed by the clickbait!

Interest Rates are NOT in the High 4% Range, unless…

I have had the following dialog with a potential client probably a thousand times or more.

Caller: What is your current rate today?

Me: (Asking multiple questions to offer them an accurate rate).

Caller: I saw/heard/was offered a rate 1% lower than what you just quoted me.

Me: How many points were you quoted?

Caller: I don’t know. Points were never mentioned.

The devil is in the detail. Yes, rates in the upper 4% range are now available. But those rates are for VA and FHA loans AND it is for a 5-Year ARM. And yes, you will pay some points to get that sub 5% rate.

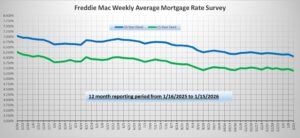

If you want to know where rates are each and every week, I publish Freddie Mac’s weekly mortgage survey reflecting thousands of loans and the rate they were locked at. Scroll down past the weekly financial news at the bottom and you see the graph.

And now the week’s economic news…….

Steady Inflation

Mortgage markets were relatively quiet over the past week. Although the inflation data was a bit lower than expected, there was little reaction. Mortgage rates ended the week slightly higher but remained near their lowest levels in three years.

The Consumer Price Index (CPI) is one of the most closely watched inflation indicators released each month. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors look at core CPI, which excludes food and energy. In December, Core CPI was 2.6% higher than a year ago, below the consensus forecast of 2.7%, and the same annual rate as last month.

The Consumer Price Index (CPI) is one of the most closely watched inflation indicators released each month. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors look at core CPI, which excludes food and energy. In December, Core CPI was 2.6% higher than a year ago, below the consensus forecast of 2.7%, and the same annual rate as last month.

Although this annual rate has dropped sharply from a peak of 6.6% in September 2022, it is still well above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. Overall prices are up about 25% since January 2020, more than double the roughly 10% increase seen in the prior five-year period. Shelter (housing) costs were up 3.2% on an annual basis and continue to be a primary reason why progress in bringing down inflation remains challenging. Other areas seeing significant increases include recreation, airfares, and medical care.

In December, sales of existing homes climbed 5% from November, well above expectations, to the highest level in nearly three years. For the full year, there were 4.06 million sales of previously owned homes, the same amount as in 2024. The median price of $405,400 was up a slim 0.4% from last year at this time. Inventories remain stuck at low levels, standing at just a 3.3-month supply nationally. However, inventories were 4% higher than a year ago.

In December, sales of existing homes climbed 5% from November, well above expectations, to the highest level in nearly three years. For the full year, there were 4.06 million sales of previously owned homes, the same amount as in 2024. The median price of $405,400 was up a slim 0.4% from last year at this time. Inventories remain stuck at low levels, standing at just a 3.3-month supply nationally. However, inventories were 4% higher than a year ago.

It was a good week for mortgage applications, especially for refinancing, according to the Mortgage Bankers Association. Applications to refinance jumped 40% from last week and were a massive 128% higher than one year ago. Purchase applications rose 16% from the prior week and were up 13% from last year at this time.

Next Week

Looking ahead, investors will continue to monitor comments from Fed officials for hints about future monetary policy. It will be a very light week for economic data, with mostly reports from several months ago which were delayed by the government shutdown. Mortgage markets will be closed on Monday for MLK Day.

Until next week….

*** Please note that Freddie Mac publishes their weekly rate report on Wednesday mornings from data received Monday and Tuesday.

The graph above is intended to shown rate trends, and not “today’s current rate”. ***

Reviews From Our Past Clients

With every client, we promise to provide you with a comprehensive analysis of your mortgage needs, the best service possible, and the best rates we can find. We make it our mission to have every transaction close with our clients happy with the service we provided. Browse through the hundreds of reviews we’ve received from our clients posted on both Google and Zillow.com, and read what they thought of their experience using Hawaii Mortgage Company.

Google Link:

Hawaii Mortgage Company Review on Google.com

Zillow.com Link:

Hawaii Mortgage Company Reviews on Zillow.com

Our Rate Quote System is Available to You

Our automated rate quoting system is live. Now you can check rates and try different scenarios 24-hours a day. Remember, it’s just a computer. For non-standard rate quotes, such as construction, vacant land, and other specialty programs, you’ll still need to give a call.

Here’s the link: https://www.hawaiimortgage.net/todays-rates/

Do you think all lenders are the same?

There is a difference when you use Hawaii Mortgage Company for your financing. Here’s a short video telling you why:

Broker vs. Banker?

Click the link below to get a quick lesson on why working with a Mortgage Broker will benefit you on your next transaction.