Compliments of

President | NMLS #: 297154

Hawaii Mortgage Company, Inc.

Company NMLS #: 232582

Alan Van Zee is one of the top producing Mortgage Originators in the state, originating over $2,000,000,000 to date. He has written and published this weekly newsletter for the past 18 years. It is the most widely read mortgage, real estate, and finance publication in Hawaii.

Hawaii Mortgage Company, now in our 26th year of providing mortgages to the people of Hawaii, is proud to have a complaint-free history. We make sure our clients are happy!

News and Insight

For the Weekend of January 31st, 2026

Hawaii’s Most Read Mortgage, Real Estate, and Finance Publication for 18 Years

Volume 18 – Issue 19

Hawaii Will Never See Affordable Housing

If you’ve been reading my newsletter for a while, you know I have openly complained and questioned why a developer with the help of the government cannot produce housing for sale that is actually affordable. When I use the term affordable, I am referring to mainland home prices - $300,000 to $400,000.

I have spent the past few months doing research by talking to developers, builders, and government leaders specifically in the housing sector. Today I’m going to share their feedback as to what they believe prevents us from having affordable developments. Regardless of the reasons, the sad reality is the title of today’s article: Hawaii will never see affordable housing.

There’s been lots of talk as to why it is so expensive to build here, pointing fingers at one reason or another. After talking to all the players, I found one underlying thread that is common. The bottom-line truth as to why nothing can be built here inexpensively is due to our culture here in Hawaii.

Don’t get offended and stop reading. I’m not criticizing our local culture. There are certain aspects of local culture that make it very expensive to do business in Hawaii. Let’s dive into those things that drive up the cost of building in Hawaii.

The Culture of Over Regulation:

We must love how our government works because we seem to elect the same people over and over. It seems once you are in elected office, that job is yours until you no longer want it. That establishes a culture throughout our county and state government that they can do whatever they like without the fear of being voted out of office. When was the last time you asked your local politician that you voted for in the last election why you should give them your vote again?

Rarely is it the purpose of government to relinquish control over our lives. Every year more laws are passed that expand government’s regulation over us. Hawaii has become one of the most overly regulated states in the country. While the intent may be noble, the result is a bloated bureaucracy with multiple levels of control – often duplicated between county and state agencies.

This is a major impediment to fast tracking housing projects. It often takes years for a developer to obtain all the plans and permits before a single shovel of dirt can be moved. Those multi-year delays add millions in carrying costs for developers. Think of all the expenses of getting a loan to buy a property, then float the costs to do all the plans required, then keep a staff employed for 5 years before the project can even start. The developer can’t eat those costs. They get spread throughout the underlying cost of each unit in the project.

Until we as a culture hold our politicians’ feet to the fire, they will continue to raise our taxes and add bloat to our government with us paying the price. That bloat will only add to the cost of building affordable homes in Hawaii.

The Culture of being Pro-Union (Government):

Hawaii also ranks as one of the top states for union membership per capita. I believe every employee has the right to collectively bargain for wages and benefits. Where I do see a huge problem is with government employee unions. There’s a huge conflict that is so evident in Hawaii that politicians succumb to the demands of the unions that in return help those politicians get reelected. Not every state has public sector unions. The ones that don’t have a reputation for being the most efficient.

I spoke to one government insider that was frustrated that you can never fire a government worker in Hawaii. I was told that the problem of underperforming workers is so bad that it often takes 2-3 times as long for government workers to accomplish the same task as it would in the private sector. The dirty secret inside the government offices is that 25% of the workers there are doing a great job and stive to do as much as they can. 25% are there doing exactly their job description – nothing more and nothing less. And 50% are there, milking the system to do as little as possible. And since each job in government is rigidly classified with metrics, a specific job description and pay rate, specialized workers for specific tasks are impossible to hire because it will either take too long to get the union and government to agree on a new position, attract that specialist because of inflexibility to pay them a market wage.

Until we change the culture of how we employ those that serve us in government, that work will continue to be inefficient and end up costing us more in the long run.

The Culture of being Pro-Union (Trades):

A very bright professor that taught a class on labor and business one said to me “labor unions are the result of a failure of management”. What he meant was that if management met the needs of its workers there would be no need for unions.

What I do know is that Hawaii will never have a major construction project that does not have union workers. I also know that no politician for a major office in Hawaii will get elected without the support of the local trade unions.

The cost of labor in Hawaii is significantly higher than almost everywhere in the country. The labor component in a large housing development is a huge percentage. In many cases it is the largest cost factor of the entire project.

We as a culture must recognize that while unions serve a worthy purpose, the cost of unionization in both government and trades add to the overall expense of any housing project.

The Culture of Respect for the Buried:

Respect for one’s ancestors is noble and good, yet there’s a price we pay to maintain that respect. To promote the “sensitive treatment of Hawaiian burial sites through cooperative and shared decision making with representatives of the Hawaiian community,” the Hawaii State Legislature established the Island Burial Councils, under the Department of Land and Natural Resources. These councils work alongside the State Historic Preservation Division (SHPD) and the Office of Hawaiian Affairs (OHA).

Areas having known burial sites require an exhausted excavation done prior to development of the site. When bones are found, anyone claiming lineage can have a voice in the decision of what to do with the iwi. If the decision is made to relocate, archeologists and cultural practitioners are brought in to do the delicate work. For a developer, relocation is the cheaper outcome. If the decision is made to preserve the site in place, nothing can be built over the deemed sacred site. For a high-rise building, that could result in the elimination of one or two “stacks” of units on each floor of the project that would have been built above the burial spot. Finding iwi in a known location could drastically change a major project or even doom it from ever being built due to the financial ramifications.

We can at the same time have respect for the past, yet recognize we need room to grow. If we are to meet the needs of the future, we need to be able to rationally discuss how to deal with ancestral remains. The way the system is currently set up, no consideration is given to the impact the development will have on meeting Hawaii’s future needs. The system is only designed to protect the past.

Until we culturally come to terms with how to rationally and respectfully deal with iwi kupuna, it will severely impact the cost of new housing developments in our island home.

We need to be honest with our kids and the families that are just starting out. We won’t change our culture, and Hawaii will never have affordable homes. That means for many of those that choose to stay home, it will result in being a lifetime renter. The greatest opportunity for wealth in the US is through homeownership. If you take away that opportunity, it will only widen the gap between those that have and those that have not. It does not provide the ability to have a robust and meaningful middle-class lifestyle.

And now the week’s economic news…….

No Surprises from Fed

The Fed meeting on Wednesday revealed no unexpected news, and its impact on mortgage markets was minor. Inflation data delayed a bit by the government shutdown far exceeded expectations, but it also caused little reaction. As a result, mortgage rates ended the week nearly unchanged.

After reducing the federal funds rate by 25 basis points at each of the last three meetings, the Fed held it steady at a range of 3.50% to 3.75% as expected. There were no significant surprises in the meeting statement, which contained a small improvement in the outlook for economic growth. It also noted a more even balance of risks between their mandates of low unemployment and stable inflation. The statement from the prior meeting described potential labor market weakness as the greater threat. Investors anticipate that the next federal funds rate cut will take place in June. In addition, President Trump on Friday nominated Kevin Warsh to succeed Jerome Powell as Fed Chair when his term ends in May.

An inflation indicator released this week, which measures wholesale costs for producers, came in far above the expected levels. The December core Producer Price Index (PPI) jumped 0.7% from November, well above the consensus forecast of just 0.3% and the largest monthly increase since July. Core PPI was 3.3% higher than a year ago, up sharply from an annual rate of 3.0% last month and also the highest level since July. Core PPI remains well above the 2.0% target level of the Fed. However, the reaction was minor since investors tend to place a lot more weight each month on the Consumer Price Index report, which better reflects overall inflation levels in the economy.

The latest confidence survey published by the Conference Board revealed that consumers remain worried about the economic outlook, the labor market, and geopolitical tensions. In January, the index unexpectedly dropped to just 84.5, far below the consensus forecast of 90.0, and the lowest level since 2014.

Of note, the decline was widely spread across ages and income groups. In particular, the outlook for future labor market conditions weakened. The number of people who feel that jobs are difficult to find rose to the highest level since February 2021 during the pandemic.

Next Week

Looking ahead, investors will continue to monitor comments from Fed officials for hints about future monetary policy. For economic reports, the ISM national manufacturing sector index will be released on Monday and the services sector index on Wednesday. The key Employment report will be released on Friday, and these figures on the number of jobs, the unemployment rate, and wage inflation are always closely watched.

Until next week….

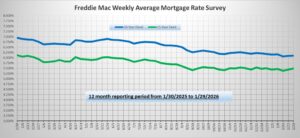

*** Please note that Freddie Mac publishes their weekly rate report on Wednesday mornings from data received Monday and Tuesday.

The graph above is intended to shown rate trends, and not “today’s current rate”. ***

Reviews From Our Past Clients

With every client, we promise to provide you with a comprehensive analysis of your mortgage needs, the best service possible, and the best rates we can find. We make it our mission to have every transaction close with our clients happy with the service we provided. Browse through the hundreds of reviews we’ve received from our clients posted on both Google and Zillow.com, and read what they thought of their experience using Hawaii Mortgage Company.

Google Link:

Hawaii Mortgage Company Review on Google.com

Zillow.com Link:

Hawaii Mortgage Company Reviews on Zillow.com

Our Rate Quote System is Available to You

Our automated rate quoting system is live. Now you can check rates and try different scenarios 24-hours a day. Remember, it’s just a computer. For non-standard rate quotes, such as construction, vacant land, and other specialty programs, you’ll still need to give a call.

Here’s the link: https://www.hawaiimortgage.net/todays-rates/

Do you think all lenders are the same?

There is a difference when you use Hawaii Mortgage Company for your financing. Here’s a short video telling you why:

Broker vs. Banker?

Click the link below to get a quick lesson on why working with a Mortgage Broker will benefit you on your next transaction.